The china short thesis now becomes the 2nd most over-crowded trade in the entire market. Hot hand bias is in full swing, the expectation is now for very pop to be sold and the “decline” of the Chinese economy to continue. After years of bulls screaming for a recovery the rooms gone quiet. People have had enough and view the china long not only a bad bet but a huge opportunity cost. Can you really blame them? Staring into the abyss for two years takes it toll, those who spent thousands upon thousands of hours re-assuring themselves now give in to the emotional pain.

I for one have been trading around China for years, the volatility has provided some high R/R trades once valuation and positioning extremes are met. During this period the Chinese economy has been slapped, the CCP has scared off almost every living soul but the bull thesis has continued to improve.

I was going to spend a few days outlining all the data that supports the bull thesis, right here and right now. Then I received an opportunity to play golf and decided the latter was a more beneficial use of my time.

So instead, yes, I do believe this is the pivotal point where China begins a new leg. Straight out of stage 1 with nothing but disbelief from those bag holding (whom will sell) and the hot handers, who will continue to short pops. For the most part nobody will get long, the media will remain negative on China and volume will pour in starting a new bull market.

Below are a few of the most recent catalysts and the consensus.

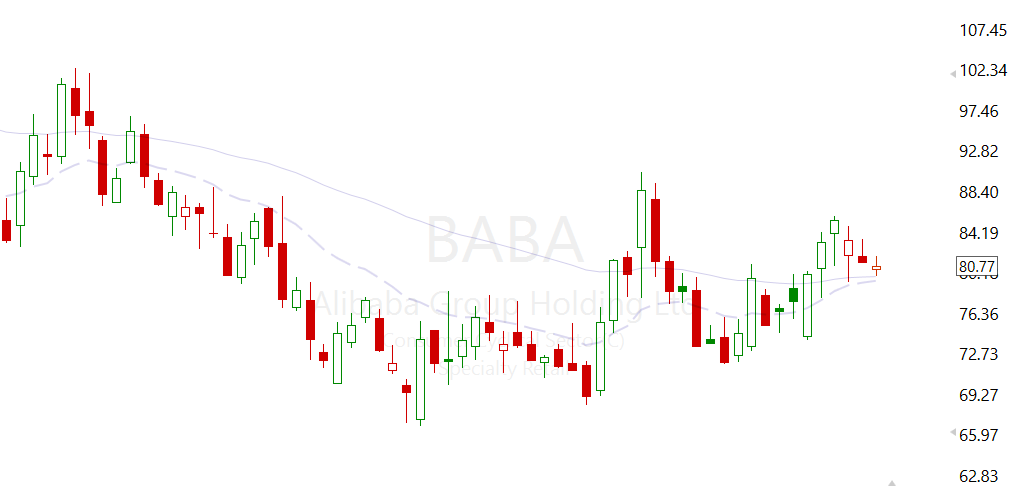

The BABA investigation is over, tomorrow it moves towards a dual listing enabling mainland china to purchase stock for the first time. The consensus? That nothing will come of it.

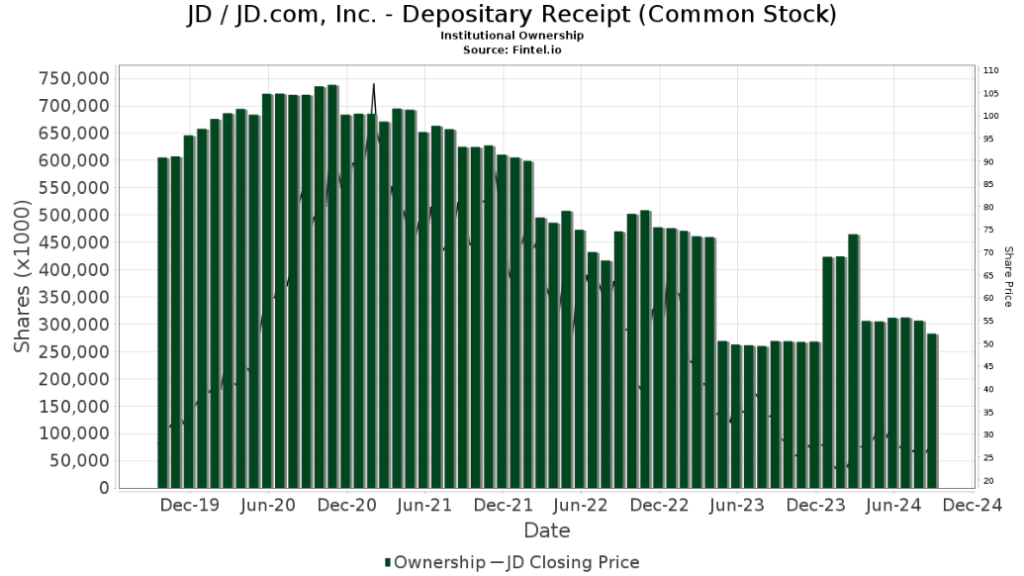

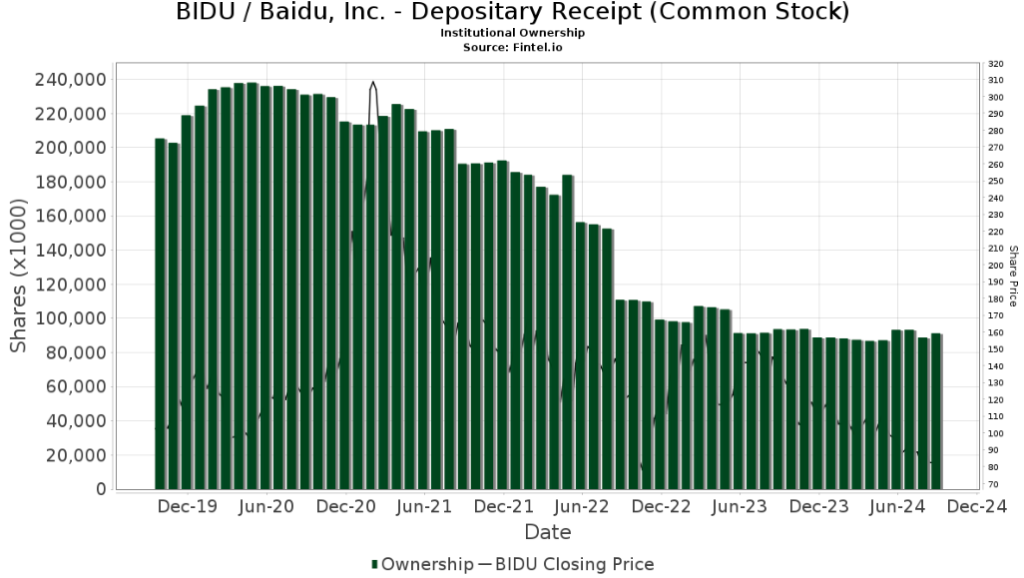

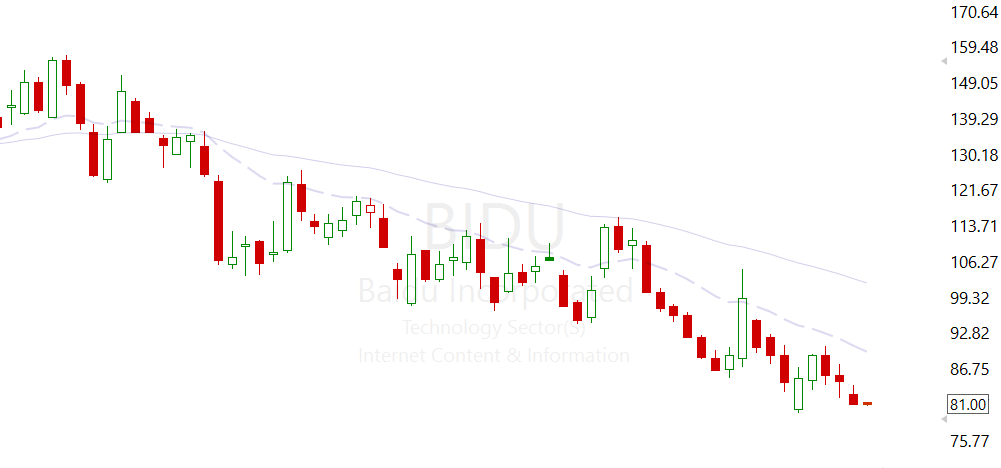

The largest technology companies in China inc JD, BABA, BIDU and many more are buying back stocks at nose bleeding rates. The Consensus? The money is being wasted, set on fire if you will.

Large super investors such as M Burry, Soros, David Tepper and many more begin to position heavily into China, the Consensus? They’ve all lost their minds.

If earnings are good then they’ve lied, if earnings are bad then they’re accurate and the economy is going to zero. News such as Tesla and Apple having 20% of their total revenue attributed to sales in China is dismissed.

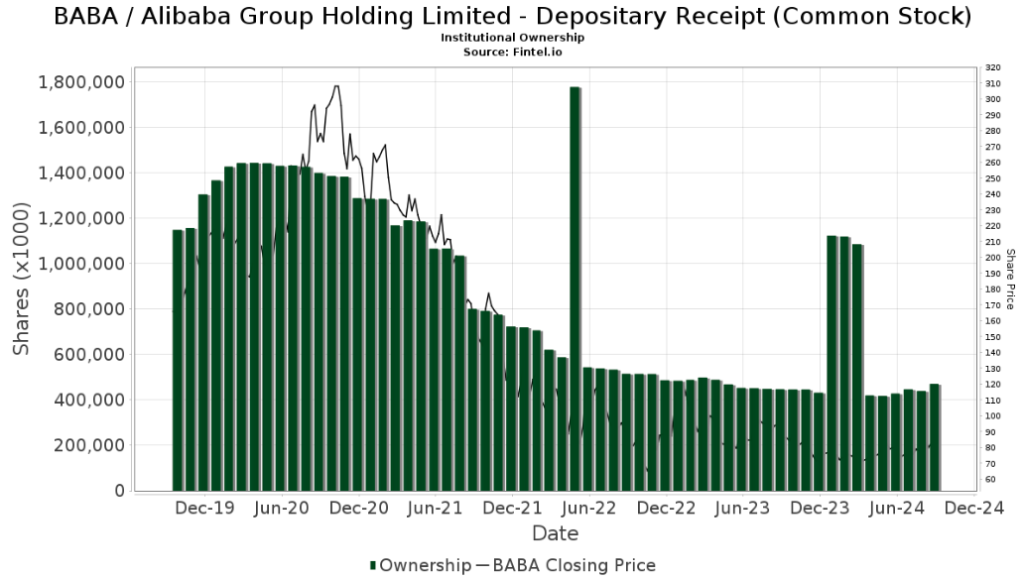

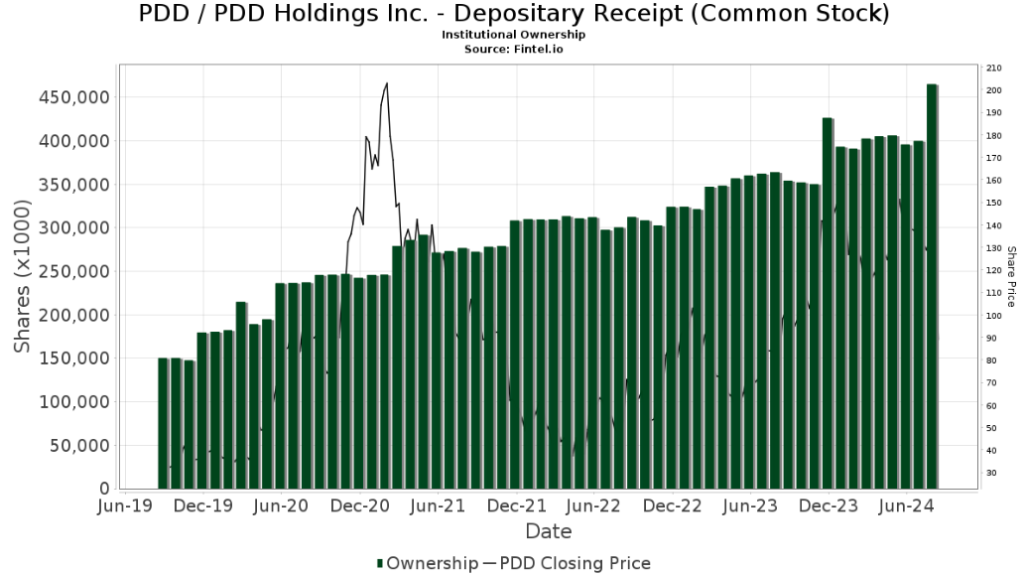

The consensus is, China is un-investable. Most institutional investors have sold out of their positions.

BABA – 7% Institutional Ownership.

PDD – 29% Institutional Ownership.

$JD – 16% Institutional Ownership.

$BIDU – 19% Institutional Ownership.

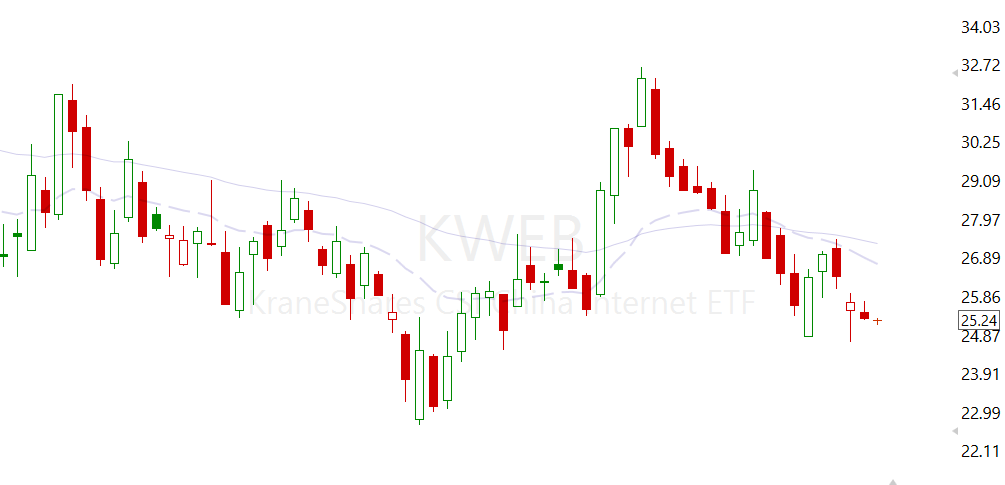

$KWEB – 19% Institutional Ownership.

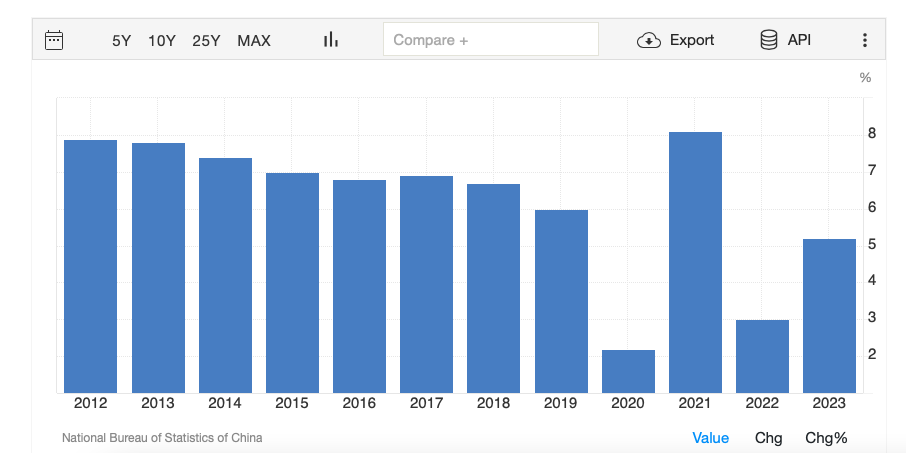

Chinas full year GDP growth since 2012,Source https://tradingeconomics.com/china/full-year-gdp-growth

Meaning, they will have to chase and get back in. Below are a few weekly charts to compare in the upcoming months.

$BABA – PE 10

$JD – PE 7

$BIDU – PE 7

$KWEB

Leave a Reply