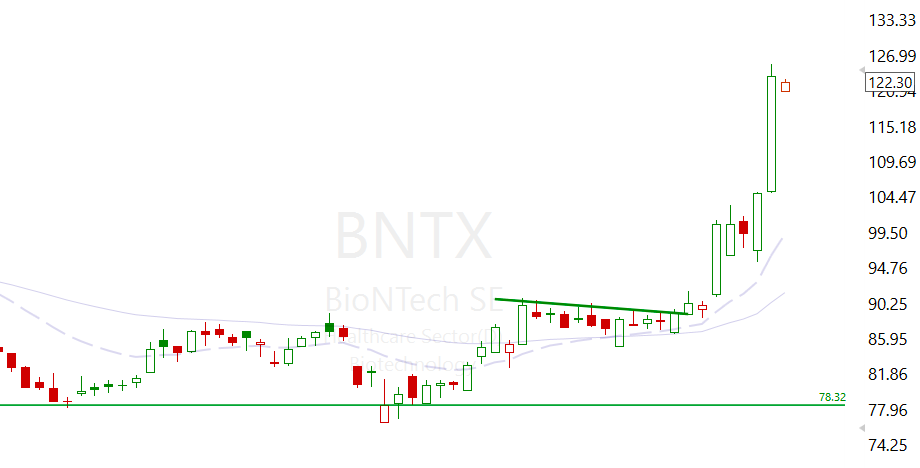

Following on from my $BNTX idea posted earlier in the year, which whilst being early played out beautifully and the mis pricing of $RKLB options which also played out beautifully, I feel the rates cuts, pending catalysts and extreme hate towards Cathie Woods could fuel a Genomic rally. With 30% of her ARKG itself being shorted & the underlying holdings witnessing large short positions, we could witness a huge ripple effect.

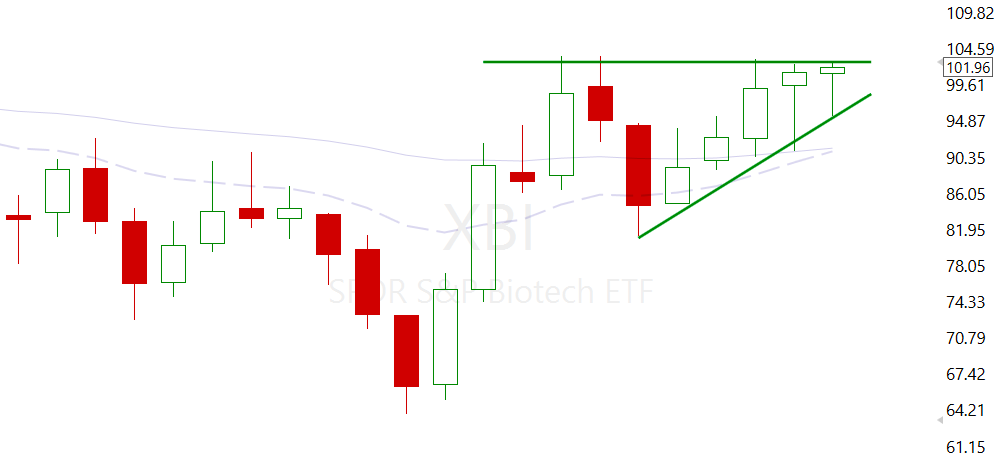

It’s no secret that the market has been pricing in the potential September rate cut in many sectors, considering it will be the first in 4 years. The thesis is, this will inevitably lead investors into taking on more risk in speculative names in search of higher yields. It also lowers the payments for companies/sectors that rely heavily on debt to fuel growth. It plays a big role in the IWM, XBI thesis and its potential to finally begin a bull run. Whilst IWM, XBI and other sectors are already pricing in this potential move and their respective option chains getting juiced, there are many still that have been forgotten.

As of late we’ve seen names like $BNTX $SMMT and many more start to break out in an aggressive manner. With XBI heading back towards 52 week highs and individual names such as $BEAM $CRSP $RXRX all pivoting on Friday with BEAM + 7.75%, $NTLA + 6.24% and CRSP 6.41%; many of their options chains are getting juiced/expensive. Which is hardly surprising, as a lot of the genomic names post huge updates in the coming weeks and rate cuts are incredibly bullish for the sector.

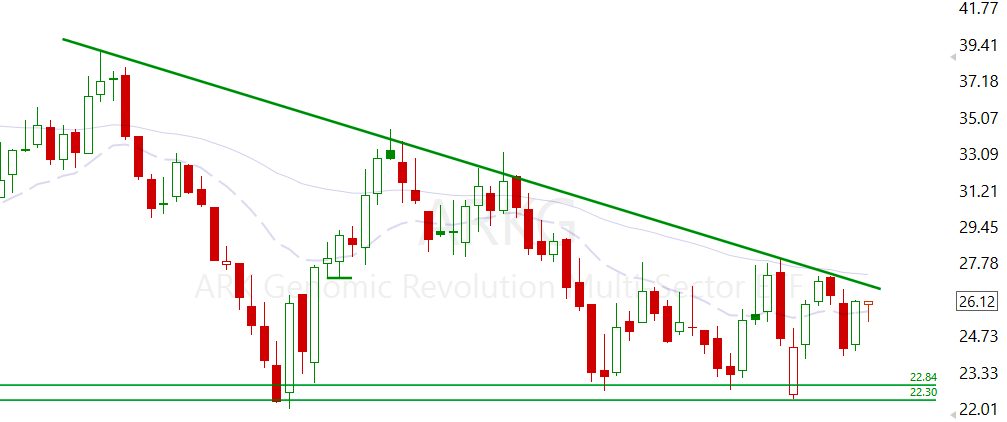

However, thanks to the hate towards Cathie Woods right now and her entire list of funds, $ARKG, which contains all of the names above, has been left behind. In fact, the fund has a 30% short position against it which for an ETF is absolutely bonkers. Now I am not bullish on most of Cathies wild claims, however facts are facts. The call options are not pricing in the potentially huge move this ETF can make. This is the exact same thing I noticed with $BNTX, it had been totally forgotten, leaving the options to become extremely cheap, until everybody wanted in – of course.

I have gone over all the holdings and checked the financial situation of each company, how much cash runway they have, their short floats, fund positioning and when data is likely to be released. When I take that into account, along with the rate cuts on Wednesday, the fact that most of the weighted names have huge potential, large piles of cash and catalysts pending, this feels like a great arbitrage play.

Biotech has done a whole lot of nothing in 5 years, ever since the first rate hike, even though AI continues to show signs of benefiting the industry. Cathie Wood has become one of the most hated and mocked fund managers of our time. Almost every name has a medium to high short float and the sector isn’t being priced as though a big move is coming, yet the individual holdings do.

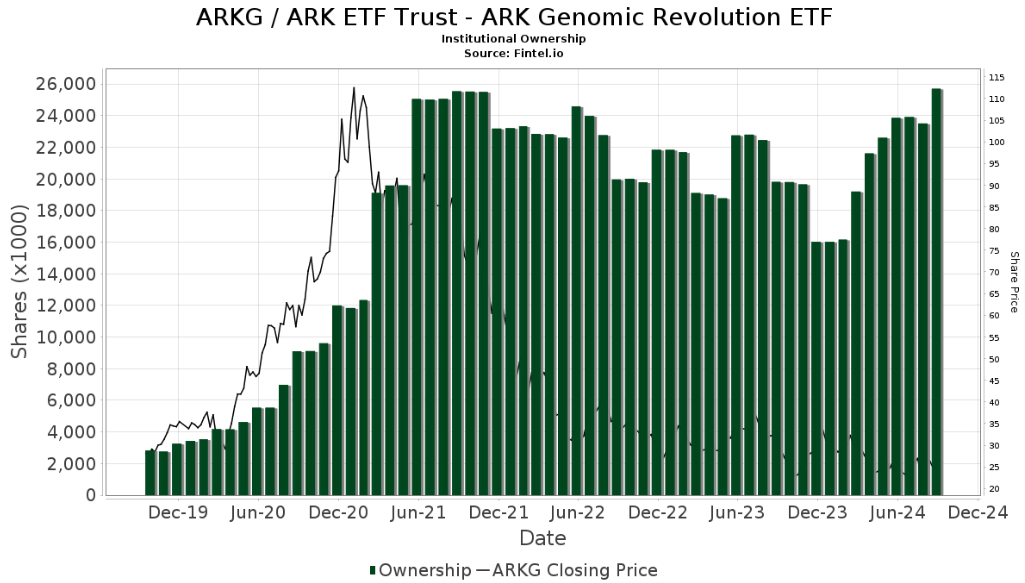

In the last couple of weeks we’re seeing institutional inflow into ARKG and many of the individual holdings themselves, which suggests a potential turning point is on the horizon.

The genomic sector is complex and very few understand the intricate details of each company. $ARKG is therefore the easiest way for many to get exposure, as money piles in it pushes the ETF higher, causing a covering in both the ETF and underlying securities.

Once this even begins to take place I’m expecting to see a surge in IV, short covering and essentially ARKG options priced much more aggressively. With such an extreme Short interest on the fund itself and the underlying holdings, I’m interested to see how that cascades like a stack of dominoes. Biotech is known for huge and oversized moves thanks to the very difficult nature of pricing the underlying security. I’m expecting this to happen in the next couple of days. (I of course could be wrong 😂)

A full list of her holdings can be found here: https://www.ark-funds.com/funds/arkg

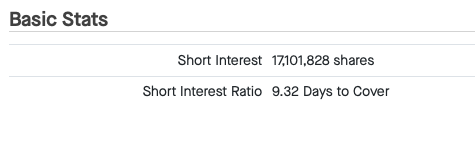

$ARKG – 50.9m shares outstanding, of which 17m are short.

$TWST – Market Cap: $2.61b Cash on Hand: $0.3b Short Float: 16.73%

$CDNA – Market Cap: $1.55b Cash on Hand: $0.22b Short Float: 6.69%

$RXRX – Market Cap $1.83b Cash on Hand: $0.3b Short Float: 25.6%

$CRSP – Market Cap $3.91b Cash on Hand: $0.55b Short Float 21%

$NTLA – Market Cap $2.1b Cash on Hand: $0.8b Short Float: 16%

$TXG – Market Cap $2.72b Cash on Hand: $.38m Short Float: 6%

$IONS – Market Cap $6.47b Cash on Hand $2.3b Short Float: 7.03%

$VCYT – Market Cap $2.34 Cash on Hand $0.2b Short Float 3%

$NRIX – Market Cap $1.6 Cash on Hand $0.11b Short Float 14.62%

$ADPT – Market Cap $0.67 Cash on Hand $0.06b Short Float 6%

$BEAM – Market Cap $2.17 Cash on Hand $0.293b Short Float 15%

Below are a few of the catalysts being presented.

- NTLA ATTR huge data update

- BEAM 101 SCD data at ASH

- CRSP CTX-112 CAR-T data

- NTLA 2002 Phase 2 Data

- BEAM 201 Data at ASH

- BEAM NHP ESCAPE Data at ASH

- SANA Data Update

Summary: People buy the weekly breakout causing those whom are short the fund to cover, thereby increasing the buying pressure of the ETF and underlying securities. This then causes those who are short the underlying to cover, adding buying pressure and further fuelling the covering of the ETF. Meanwhile real buyers step in due to the extreme value being presented regarding the points outlaid above. The reduction in rates could be all that’s needed to start this domino effect. Thanks to the hate towards Cathie Woods many more will continue too short, merely adding fuel to the fire.

A mere 30% move into the $35 region could provide some incredible 5/1 and 10/1 opportunities. It’s worth bearing in mind that this would only put the ETF flat for the year, a very realistic expectation.

As with all my “ideas” this is not financial advice and I currently have calls in ARKG.

Leave a Reply