**Weekly Trend:**

**SPY:** :green_square: **QQQ:** Uptrend **XLE:** :green_square: **ARKG:** ::green_square: **IWM:** :green_square:

**Current Themes on Watch**

AI Biotech (ARKG, RXRX, PRME etc) Weekly Trend: :green_square:

Robotics (OUST, SYM, TESLA, SERV etc) Weekly Trend: :green_square:

Energy (XLE, Natural Gas, Coal, Oil, Plug) Weekly Trend: :green_square:

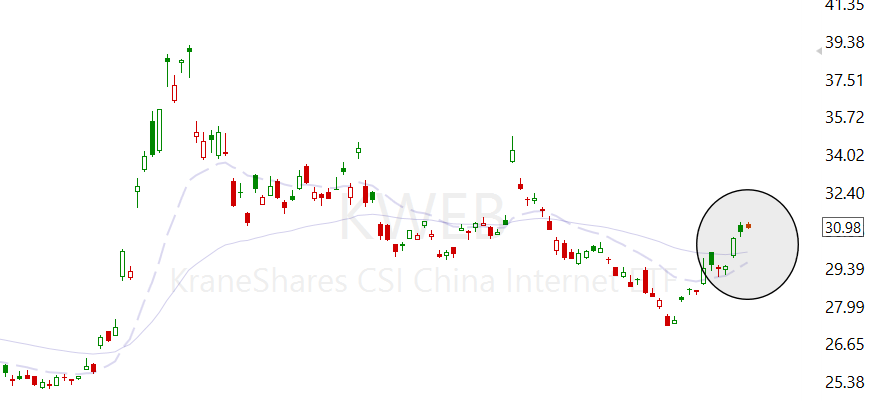

China (KWEB, BABA, JD, BIDU etc) Weekly Trend: :green_square:

**Names on watch for new entry or add (dependant on market)**

$ARKG (BEAM, NTLA, PRME, RXRX)

**Names added/removed from In Focus List**

None. (updated 28nd Jan 2025)

**Daily Brief:**

Following yesterdays price action, it’s safe to say we’re likely in for a lot of chop.

There are so many arguments across news outlets, social media and alike regarding the legitimacy of Deepseek. Irrespective of your opinion, what they have achieved is possible and the tone towards AI names has therefore changed. I have discussed my thoughts on these LLMs in-depth, with my largest concern that none will ever produce a cent of positive FCF. As far as I see it, the sector is not worth playing long nor short.

China has caught a bid yet it’s very narrow, we’re yet to see if that broadens in the coming days. TUYA, DADA & YRD are catching strong bids, to name a few less obvious names. KWEB as a whole looks good but that’s thanks to just a handful of names. I want to add exposure here if buyers continue to step in.

A range build in this area would be ideal.

As much as I’d love some more action here, I’m currently waiting for a good pitch to swing at, like $VNET a few months back. It’s funny, when the watchlists are small I always feel “unproductive” and question whether I’m just being lazy. Yet overtrading is one of the Main reasons most won’t ever turn a profit, be patient.

Leave a Reply