**Current Themes on Watch**

AI Biotech (ARKG, RXRX, PRME etc) Almost every name in the sector stuffed and failed to reclaim their daily uptrend, following the universal market theme of “sell all pops”. Still looking for that RXRX entry against the weekly, at which point I’ll be positioned in the sector. I plan to size up PRME and NTLA once weekly uptrends are established.

Robotics (OUST, SYM, TESLA, SERV etc) More stuffs across the board following SERVs offering of $80m (10% of its current market cap). This was always going to happen and we’re only going to see more of it take place as time goes on.

Energy (XLE, Natural Gas, Coal, Oil, Plug) Interesting development yesterday as Energy names lead the charge for the first time .

**Names on watch for new entry or add (dependant on market)**

RXRX against $7.09

**Names currently flagged:**

RXRX, RIME, ABAT, CXAI, VSAT, TPIC, TEM, NVTS, RZLV, PATH, SYM, EH,

** Daily Brief**

The market continues to stuff with NVDA truly leading the charge, almost all sectors were sold into yesterday and even the recent higher flyers such as ARBE, PLTR, SOUN got slapped.

Names like TSLA, APPL, MARA, AMZN and many more liquid leaders are entering daily downtrends. It doesn’t mean they can’t instantly reverse yet it’s a sign to remain more cautious.

Liquid leaders fading and new breakouts stuffing are not what you want to see when trading long. Until this changes just remember cash is a position.

As mentioned in the “current themes on watch” a lot of the names moving are cash strapped and require tremendous sums to reach their manufacturing stage. Even then most will fail initially to turn a profit. A regular reminder, if they have no FCF then you are their cash flow.

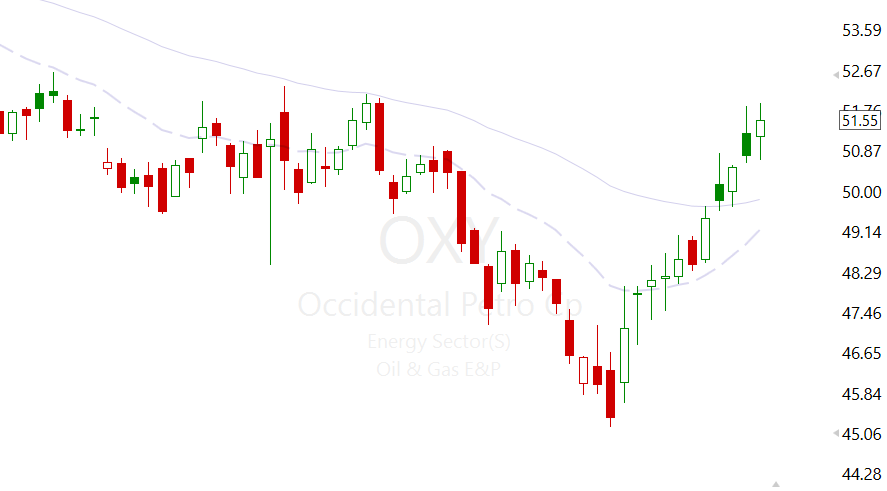

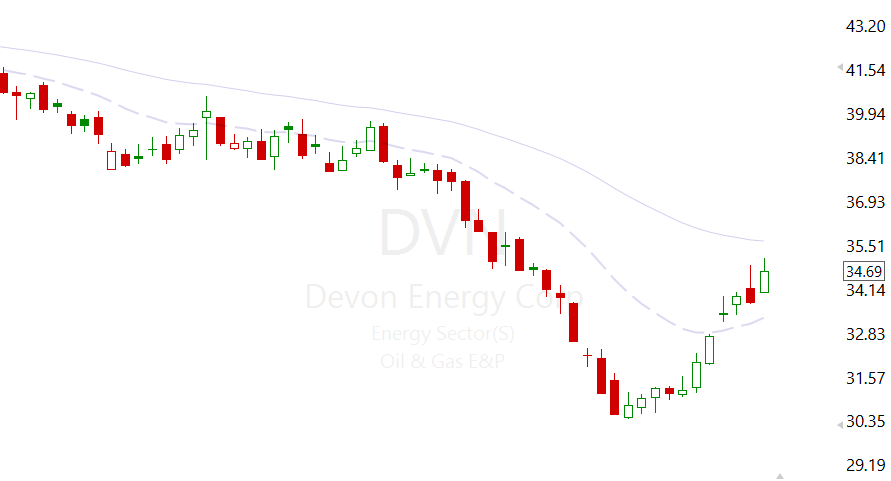

The only obvious sector that stands out right now is energy, with almost every name I track pushing back into a daily uptrend. CVX, XOM, OXY, EQT, SLB, MPC, CTRA they’re all back with a strong bid. Which is being back by a rise in both Oil & Natural Gas prices.

**XLE**

**OXY**

**$DVN**

The list goes on and on, these kind of V shape recoveries often continue with a sustained bullish trend. As long as this price action holds it’s looking like the Energy sector is building its first leg and finally moving higher.

Aside from that there’s still little to add to Mondays watchlist, given the market is closed tomorrow and including current price action, taking the rest of the week off is an easy choice. I’m travelling to Delhi and then Agra, plan was to work alongside yet I see no point here. I’ve got alerts set for the names mentioned over the last couple of days, aside from which the next watchlist will be Monday.

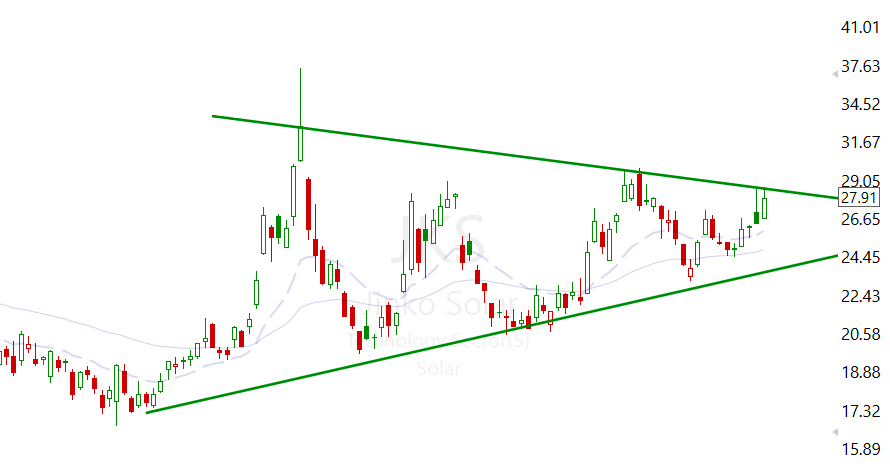

Previously mentioned setup fully formed…

**JKS** Given that the Chinese government is backing renewable energy companies both financially and politically, and given JKS is the worlds largest and most advanced Solar Panel manufacturer, this weekly/daily is looking gorgeous. However, as stated yesterday, I prefer the Energy storage player FLNC and so continue to research the sector before making a decision, as a trade I’m happy to take JKS regardless.

Leave a Reply