**Current Themes on Watch**

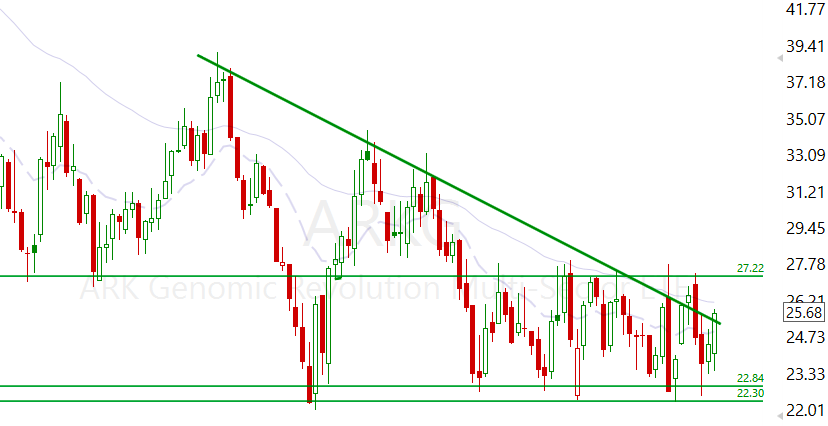

AI Biotech (ARKG, RXRX, PRME etc) This sector has now been on watch for yet another month, still remains in a choppy phase and below key resistance. PRME & RXRX seem to be getting the most attention and are my favourites here in the Space.

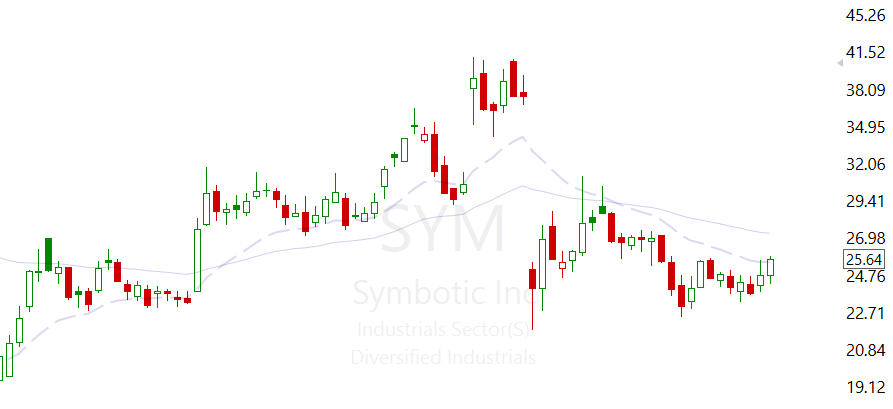

Robotics (OUST, SYM, TESLA, SERV etc) In the previous watchlist these names were pulling back with little to do. That changed aggressively with strong buyers across the board. However, the buyers appear to be chasing a lot of the shit names. Maybe this is due to the wild moves in Quantum and therefore investors are happy to go full risk on. SYM remains a top watch in the sector and is finally building a strong base following the accounting mishap.

Energy (XLE, Natural Gas, Coal, Oil, Plug) The last watchlist we discussed how OXY was in capitulation mode and this has historically resulted in a strong bounce. Since then it’s bounced 10%+ and the sector looks in a much better position to get moving. In fact, Friday (the last trading session) XLE finally closed into a bullish uptrend for the first time in 21 trading sessions. Natural Gas continues to be the leader with EQT the leading stock.

Battery Tech – We’re seeing aggressive buyers step in for anything battery like QS, FREYR etc. Given the move in energy and the obvious demand increase (see above) energy storage plays a critical role in keeping things online. TSLA and FLNC dominate this.

**Names on watch for new entry or add**

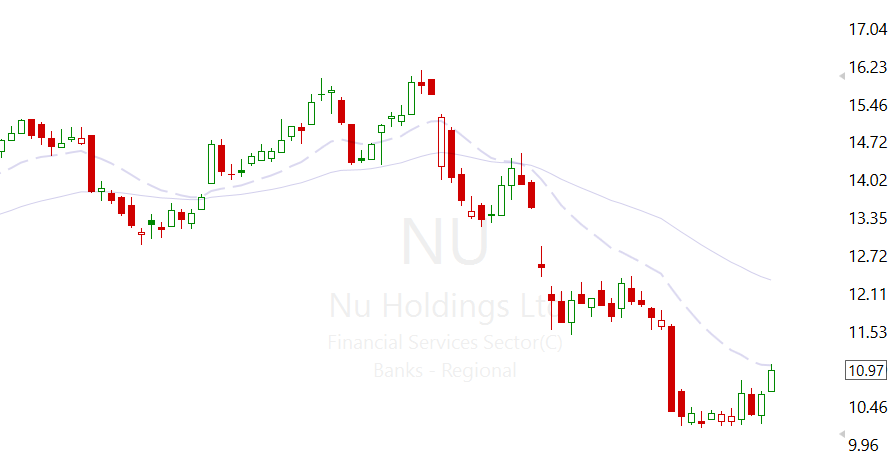

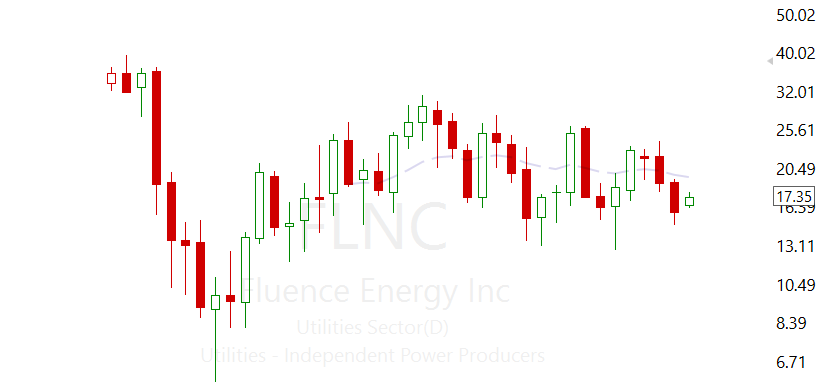

MP AGAINST $17.50, ALB RISKING $86, NU OVER $11.10, SYM OVER $26, NTLA OVER $12.60

**Names appeared in Scan:**

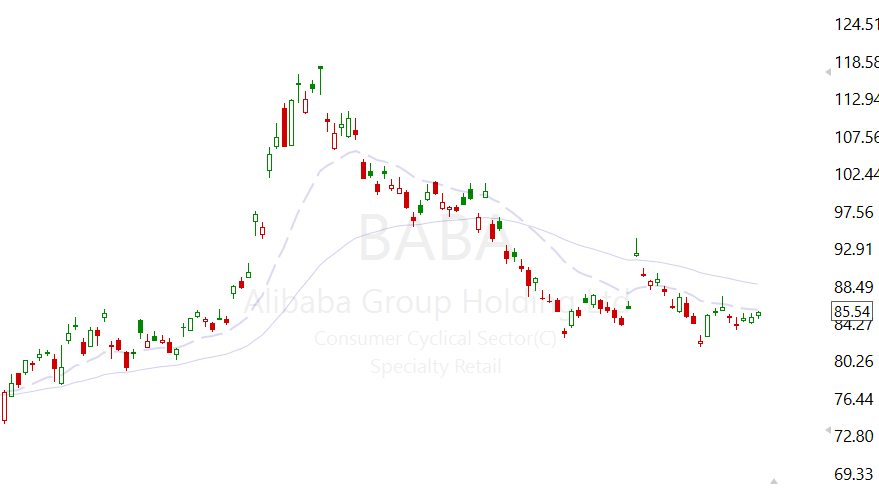

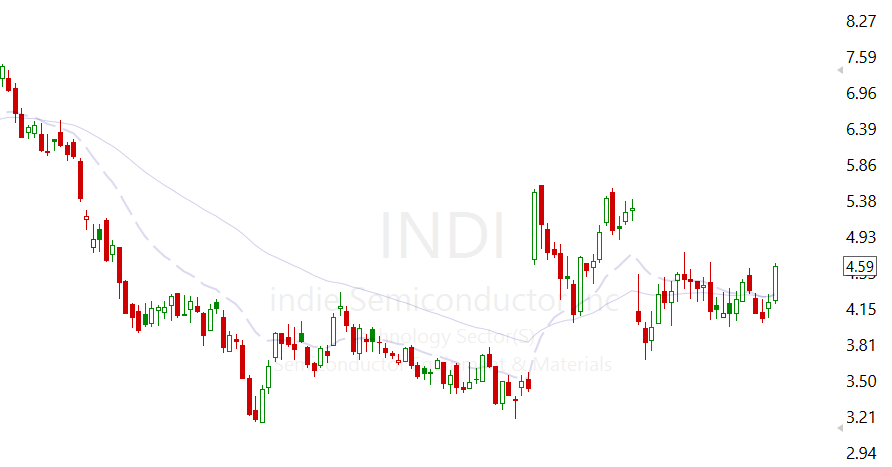

INTC, NKLA, RIOT, NIO, WULF, NU, CAN, CLF, HAO, RXRX, RZLV, WOLF, BTE, NOVA, PSNY, NXE, AQN, NINE, BABA, EE, PATH, SHLS, MRNA, ARRY, QXO, INDI, OTLY, MP, LAZR, TEM, APPS, FTNT, LAC, URG, LI, EDBL, BYON, GWAV, CCJ, SEDG, KWE, NTLA, ALB, MPC, FLNC, LNZA.

** Daily Brief**

QUBT, RGTI, QBTS lovely stuffs, which were well overdue. This should be the top in most of these names for some time. Other aggressive small cap movers like NVTS, BBAI etc also stuffed aggressively, exactly what we wanted to see.

XLE is setting a record sell off even with Natural Gas doubling from recent lows and Oil hovering around $70/barrel. Pretty wild times for this sector just as it looked to be breaking out. In my opinion this presents some great R/R opportunity at these levels and I’ll continue to buy in my passive income account. Minerals, Steel etc are all behaving just as poorly.

**$CAN** Chinese bitcoin miner and chip designer, above $2.40 could provide a nice tight entry. A lot of relative strength to the Chinese market, also in the right theme(s).

**$NU** Liquid leader in Latin America with a lot of eyes on it, buffet loves it as do other super investors. Attempting pivot into daily uptrend. A close > $11.10 risking $10.50 is a nice R/R entry for a longer play.

$RXRX – The cult seems to be growing on this name as it chops hideously, given my bullish stance on Gene Editing, AI (Biotech) etc stocks into 2025 it’s hard not to pay attention too. The weekly closed in a bullish stance once again after stopping everybody out. Tracking retail sentiment and there’s some wild momentum building. CEO still has 95% of his net worth locked inside, still backed by NVDA and the oncology drugs stand a chance of a big payout.

$RZLV – High risk name throwing around a lot of fancy terms, TAMS, blah blah blah. But, they have already secured a few big deals with leading players. They’re attempting to disrupt a huge market (yet to be proven). Their crypto checkout engine they’re working on could allow your mum and pop shops to accept crypto much easier and far more streamlined. The shopping experience vs Google could also be a great improvement. Like I said, a lot of if and maybes, yet it’s an easy name for people to FOMO into (just incase) and sits just above the fund MC threshold (700m).

$BABA – This will be its second attempt of reclaiming its uptrend since it blew up in October 2024. It’s a name a LOT will not shut up about and I get way. My reservations are that so many people are already deeply obsessed with it and it feels over-crowded. Yet checking the data this morning it’s actually far from it and simply must be the circle I am within turning into somewhat of an Echo chamber.. I’m taking about news feeds, twitter etc not the discord. If we reclaim that uptrend I’ll take a another position risking weekly low.

$INDI – Given the move in ARB OUST etc, it would make sense for this name to get moving. Involved in creating sensors and chips for semi-autonomous driving with over 400m chips already sold and a $7b backlog. Management don’t seem to over-promise but simply deliver. If they’re working on chips to compete with the likes of ARBE etc I’d expect them too announce after and not before. $700m market cap with $500m of equity, nearly 100m cash and revenue producing and 25% short. Really nice setup.

$FLNC – One massive monthly range build since IPO and down 30% from 2024 highs. I find this kind of ridiculous given the move in battery names the past few weeks, especially in the garbage bin stocks. FLNC is providing battery solutions at industrial scale and their demand just keeps growing, with a backlog in excess of $7bn. Aside from Tesla this is the best company period for mass scale energy storage which benefits from Robotics, Ai, Gas, all of it. Tesla investors know this and it’s partly what keeps driving Tesla higher. A P/E of 93 makes it look extremely expensive but that’s because it’s only just flipped profitable, I can see that number getting slashed and then suddenly appearing on a lot more scans. Easy buy and hold here imo.

$MP – A name from back in the day which has only become more important in recent years thanks to the China trade war. China accounts for 95% of Europes and 80% of Americas rare earth supplies. Measures are being taken to drastically ramp up production of rare earths in the USA and prevent a choke hold from China. MP Materials:

MP Materials helps fuel the electrification of global infrastructure. We are the largest producer of rare earth materials in the Western Hemisphere, through our state-of-the-art, zero-discharge operations in Mountain Pass, California. We deliver approximately 15% of global rare earth supply with a long term focus on Neodymium-Praseodymium (NdPr), a crucial input to the powering of electric vehicles, wind turbines, drones, robots and many other advanced technologies.

Huge daily candle back into an uptrend, will look for pullbacks to the 17ema and risk Fridays low. Simple trade.

**SYM** One of the only robotic names to actually mass produce, install and utilise robotics. They have stated numerous times that they’re focused on expanding their offerings and given their current track record this could push them into one of the leading robotic makers, as they already are.

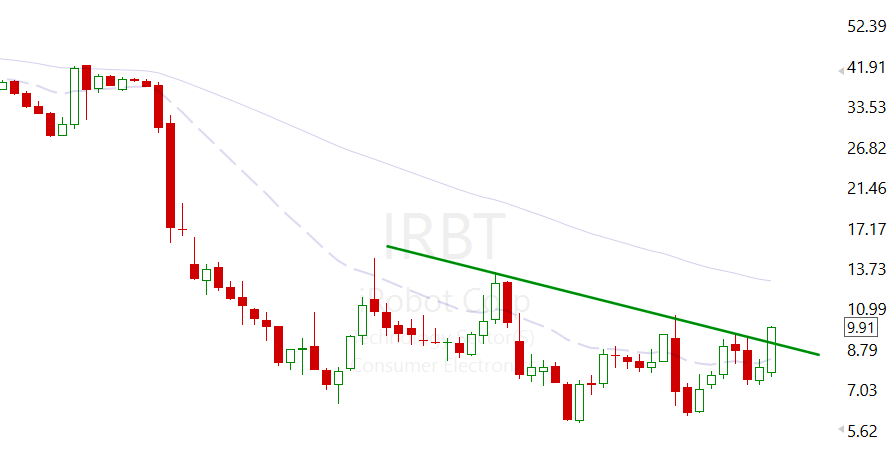

**IRBT** last but no least, IRBT has been making robots before they started to become mainstream. It’s a much more speculative play as management have shown the capabilities of a chimp when it comes to innovations, shareholder value creation, profitability and just about everything else. The reason I bring it up, is it will likely be a momentum leader and stands a chance if management can get the can.

Leave a Reply