Following trumps landslide win, the market has ripped straight into a state of euphoria, accompanied by a nice short squeeze in many names. Whilst I feel many are just at the beginning of their runs (long term) the short term data states a sharp pullback is coming.

Due to my Time off I’m mainly on the sidelines as this takes place, not ideal yet I’m perfectly fine with it. I don’t feel an ounce of FOMO and remain very clear headed and observant.

I posted on the day of trumps victory how many of the Harris voters are likely to emotionally short the pop. I believe they have helped add a lot of fuel to the fire. A crash would have enabled them to shout and scream about how they were right thereby getting some form of “payback”. If you’re a bitter Harris voter, you’re going to want a crash and you’re gunna want to short the top.

For me I must remain focused on where the best R/R is right now and I believe this to be Biotech and more specifically ARKG. I’ve traded this name multiple times already this year too much success, however, I now feel this is where things can finally get moving.

We’ve discussed how Cathie Wood is mocked and considered the worst fund manager in history. Whilst her performance has been abysmal and her timing even more so, I feel the holdings in ARKG are just the right weighting at just the right moment in time, I also feel the options chain is mis-priced.

If you try to buy the individual names you’ll quickly notice how most are very expensive, leaving you to assume that ARKG itself would be the same, since it’s made up of said holdings. Yet this is not the case, instead, they’re very cheap and are priced as if no move is about to take place. Which given the array of data being released into the year end, makes no sense at all.

The NTLA data that recently sent the stock plummeting is a perfect example of recency bias and misunderstanding of the revenue opportunity it presents. Just this one drug alone has the potential to yield $20bn in cash and yet is actually one of the smallest opportunities NTLA is working on, wild numbers for a name with an EV of $600m. They will release more important data this Saturday (16th November).

Then you have names like CRSP who have cured Sickle Cell Disease and has FDA approval in the USA, UK and Europe already.

Names like RXRX with the worlds largest biotech super computer and a CEO who has 90% of his net worth in the stock itself. With a strong Oncology pipeline that could potentially 10x the stock if any turn to be blockbusters.

The golden era of R&D returns (20-30%) is likely to return and will do so much faster once monetary policy benefits those in search of cures, something I can see happening momentarily. It’s funny, Cathie recently stated that she’s banging the table on NTLA here just like she banged the table on Bitcoin in 2015 and TSLA in 2019. Yet why would anybody listen to her now? She hasn’t been this certain on an idea since her Tesla play and yet thanks to her huge underperformance nobody cares.

If most of the names in ARKG were too double, I would still consider almost all of them good value. In fact, a 35% move in ARKG which would yield a 1,500% return would only put it back at breakeven for the year. Considering it can do 20% in a day with the right catalyst, it’s again clear that the options are not priced correctly.

For the past 4 years, shorting these names has worked, they burn lots of cash and rely heavily on dilution to continue their R&D, making the bear case easy to stick with. The problem is, many are now in late stage development and close to producing their first real revenues.

I believe people will start shouting about the opportunities of AI in Biotech and that ARKG will be the ETF they target, considering it’s the only one weighted with these specific names.

Given the ETF itself is shorted at 30% and the underlying holdings vary between a 15-25% SI, it will create a snowball effect.

A news catalyst triggers buyers to step in, forcing shorts in the individual names to cover, forcing shorts against the ETF to cover, creating FOMO and bringing aboard more buyers. During this the inflows to ARKG allow for increased buying by Cathie herself, forcing the stocks even higher.

The word “cure” can create a lot of hype and rightfully so, funds would be forced to pick up these names as Nobody wants to be the guy who didn’t invest in the companies curing real life diseases, something that’s looking very likely to take place.

Furthermore Donald trump has pledged a crackdown on the current Pharma industry with a focus on “cures”. Elon musk has touted the same things, as has Vance in a recent Joe Rogan podcast and Kennedy Jr. We’re about to see the entire US government back cured-focused Biotech which basically means ARKG. Yet everybody seems to be sleeping on it, that or I’m completely wrong

Check out the podcast here > https://www.youtube.com/watch?v=fRyyTAs1XY8

The chart also happens to agree if we can push another $1-2, This is a classic weekly pivot setup and one I would happily take based upon the chart patterns alone.

The funny part about this trade, is I will look like a fucking idiot if it fails. Imagine buying a Cathie Wood Biotech ETF at the top of a bull run… It wasn’t easy pulling the trigger here but odds are odds, had to be done.

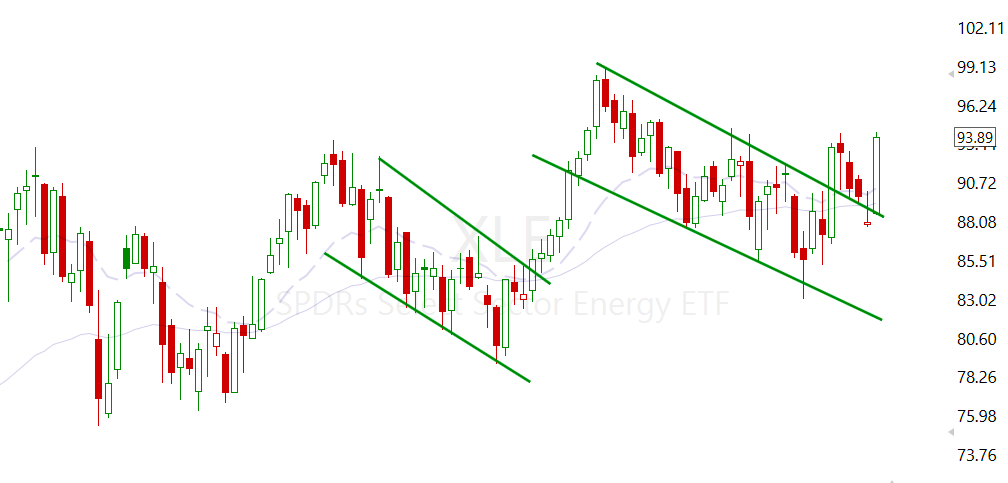

Next up, there are so lovely bases in Oil & Gas names, considering trump is looking to get rid of the Paris agreement and go full steam ahead, these companies look to benefit tremendously. It’s again a heavily shorted trade and extremely over-positioned. It’s also been a sector that has traded well this year (for me at least) and one I can see moving aggressively into year end.

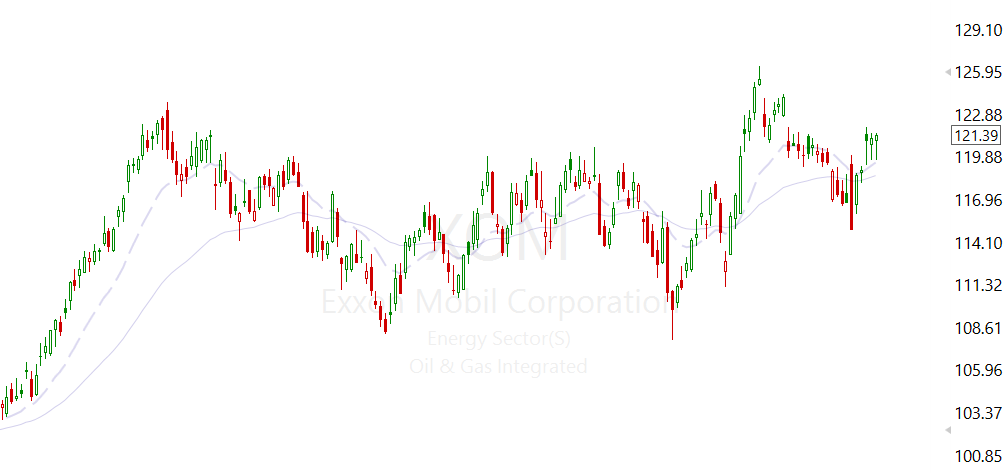

$XOM –

XLE weekly:

Leave a Reply