Yesterdays move was the largest follow through day of U.S. elections ever. The scans hit nose bleeding levels and hundreds of names including indexes ran past hyper extension levels.

I was just in a shop buying bedding for our flat (Fun I know) and got chatting to the store assistant. He asked what I did and one conversation lead to another, finishing with him showing me his stock trading account. He remarked in very broken English “the market always goes up in the end”.

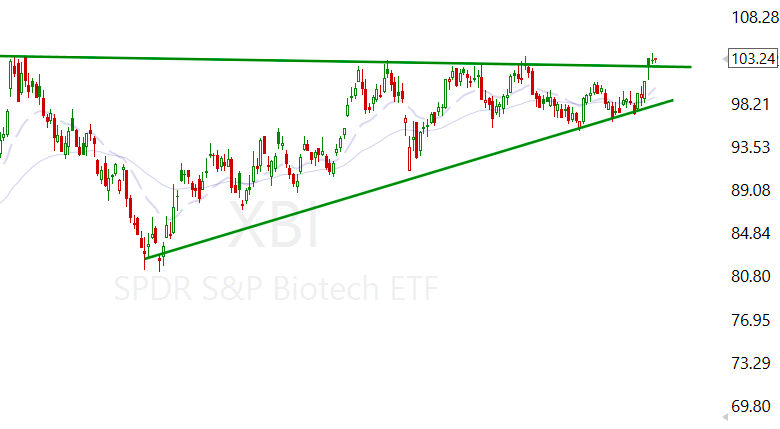

Meanwhile, XBI and other unloved, value/growth sectors also attracted a bid.

The real question is, do we yank back and then go risk on, or can these valuations really hold whilst everything else rips higher.

The positioning in China helped prevent a nice loss, everybody bullish into a “sure thing” news event is often a recipe for disaster. I’ll now add China back to the watchlist and should we flush out the chasers I’ll get long.

MELI earnings were solid and the sell-off is nothing more than short term thinking, will buy this in the fat pitch account and begin to accumulate. They are a dominating force and remain one of the best management teams ever, period.

I sound like a broken record, but the biggest winners from this election and “new power” are cure focused biotechs. The red tapes and lack of funding is about to come to an abrupt end, just as the entire world remains short. There is nothing for over-shorted than said names, nor under-positioned. They also trade at one of the lowest enterprise values in the entire market.

You know how I’m often early but rarely wrong? I feel this is one of those times, how early I am is yet to be determined. Yet if you believe insurance companies won’t pay for a cure that benefits the patient and saves them 50-60% In lifetime costs then you’re greatly mistaken.

A lot of said names trade <$500m enterprise value.

The overall biotech industry attempts to breakout, how this corresponds to the names that matter is yet to be seen.

Leave a Reply