Ever since covid Era PTON stock has been in free fall, to the tune of liquidating the former CEO and hammering his net worth from billions to <$100m. Touted as just a bike with an Ipad the bear thesis has been bankruptcy and fears of extreme customer decline following the re-opening on the worlds economy in 2021/2022.

Whatever your thoughts may be the numbers don’t lie, and, the numbers are drastically improving.

They’re expecting FCF of $200m in 2025, with a market cap of $1.7b that makes the stock very cheap. Trouble is they have $800m of debt, something the bears love to tout. Again, the problem with that thesis is they have $700m in cash on hand. If you take into account 2025 FCF estimations they’re not only surviving but thriving. They have also refinanced that debt and pushed it forward to 2029. A reduction in rates from the fed only makes this debt cheaper and easier to service.

So what about customer retention? >92%, most customers who sign up stay. With their lease model utilising used equipment this figure is expected to increase.

Their tread business grew 42% Y/Y and their Precor business 20% Y/Y

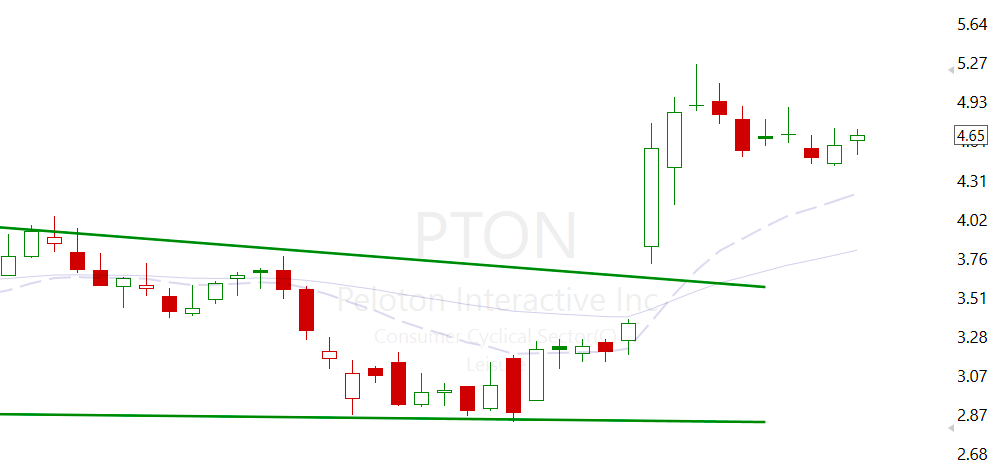

The chart strength post earnings, given the market backdrop, highlights some large money is at play. Pushing through monthly resistance levels and being held up with strong bids. Given the 20% short float and the “its just a bike with an ipad” crowd, I can see this making an aggressive move. As a realist I can understand the bear thesis in 2021/2022. However things have changed since then, People are often guilty of being unable to accept new facts once their mind is made up.

The reason I bring up CVNA is the similar chart pattern at the time, the similar story of a name potentially going bankrupt to suddenly one of a potential turnaround. Also thanks to the “Its just a car garage but in a vending machine” crowd. You need this extreme pessimism to witness prolonged squeezes. Just like a lot of people will disagree with this post and likely attempt to short it once it pops.

Given the margin of safety, trading a 8x 2025 FCF and almost half its market cap in cash, the high customer retention rate and growth returning. With the right moves this company could easily turn itself around.

I’m looking to purchase leaps and wait for what I would class as the inevitable. Bear thesis is dead and the chart says we head much higher.

Leave a Reply