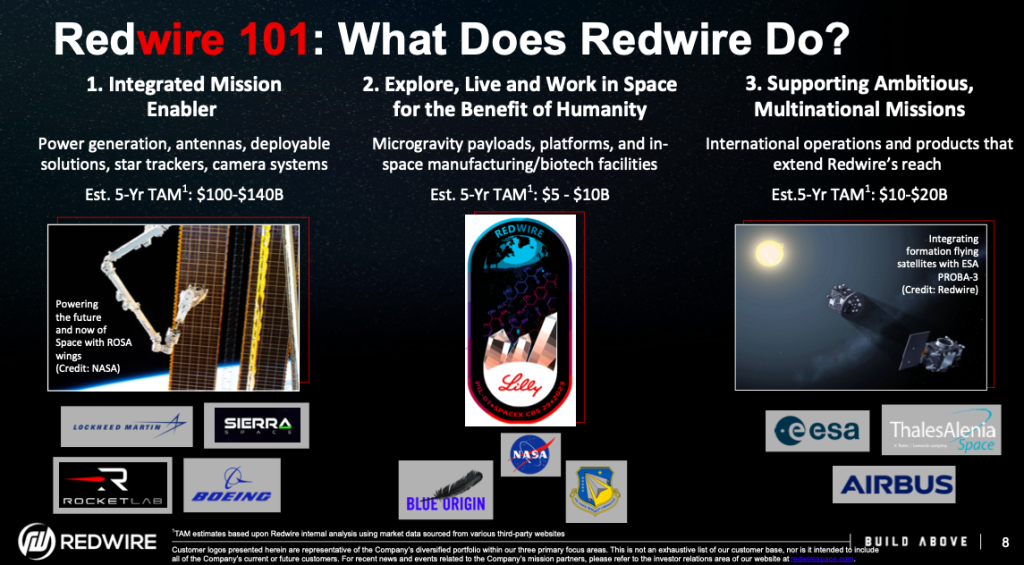

$RDW already supplies $RKLB with parts, a contractual agreement which started in May 2024. The also supply NASA, Lockheed Martin, Boeing, Blue Origin and many more.

- They are currently working with $LLY on 3D bio-printing organs in space, which they’re making great progress of.

- They acquired Hera systems to increase the dominance for national security space customers.

- They were selected to provide advanced RF payloads to a leading defense contractor.

- They have joined the US-U.A.E council where Danny Sebright stated “Redwire’s pioneering advancements in Space Infrastructure showcase the very best of American innovation and ingenuity. As a member Redwire joins an elite list of member companies at the forefront of almost every industry.

- They signed a MOU with NASA’s REMIS-2 mission to provide Spaceflight hardware, ground hardware and software, engineering services, payload facility integration and more.

- Selected to provide a critical onboard computer system for the European Space Agency Hera Mission, Europes flagship planetary defense mission.

- To supply Solar Arrays for Thales Alenia Telecommunications product line.

- Selected by (SCA) to develop, build and deliver advanced thruster technology nicknamed the (Valkyrie Thurster) designed for reliable, high-volume production for the surge in national security space programmes.

- Awarded Darpa Prime Contract to be the prime mission integrator for the development of revolutionary air-breathing satellite that will demonstrate the use of Novel electric propulsion in very-low earth orbit (VLEO).

- Awarded Contract by the European Space agency to develop a Robotic Arm to support the landing for the International Lunar Exploration Mission.

- Selected by $RKLB to provide Antennas and RF hardware.

And those are just some of the latest contracts & advancements RDW has made. They’ve been prolific aquireiers since going public and continue to aggressively expand their footprint across all space sectors.

It’s why their CEO goes by the Moto of “If space wins redwire wins”, a confident statement backed by their foundational success of becoming the “building blocks to space”

Yet it’s currently one of the cheapest and most undervalued Space stocks there is. Trading at a P/S of just 1.58 compared to RKLBs 11.5. A market cap of just $450m vs RKLBs $4.28b & ASTS $6.73b

This isn’t about who’s better, it’s about Redwire being drastically undervalued and under the radar of most growth investors.

I shared my thoughts on $RKLB 3-4 months ago after scooping the October and January calls.

Since then people have finally started to realise the potential in the company. To sit are similar valuations based upon growth and income, RDW would not to hit approximately $42/share. At this point it would still remain once of the cheapest yet most advanced space companies out there.

Why now?

Stocks move in themes, every success trader from here to timbucktoo will tell you that. It’s caused by the excitement and willingness of investors to take on risk on what they believe to be innovative and early stage Giants.

Just like when EVs moved thanks to the hype in Tesla we saw the entire sector move.

Just like when $AI started the AI run and others such as NVDA (plus plenty of others) took the button and ran for 12-18 months.

I see the Space sector as an emerging theme and names such as RDW could potentially take the baton and garner worldwide interest.

It’s currently one of the cheapest and most impressive Space stocks there is. Trading at a P/S of just 1.58 compared to RKLBs 11.5. A market cap of just $450m vs RKLBs $4.28b & ASTS $6.73b

Now don’t get me wrong, these are very different companies and I’m still incredibly bullish on RKLB. However, if this sector is here to stay then RDW stands to make an enormous catchup move.

They’re involved in literally every corner of Space development with a large lead in Space warfare and Defence.

Revenue has been growing aggressively, as highlighted in their last 7 quarters below.

Recent Revenue:

September 2022 – $37.3m

December 2022 – $53.7m

March 2023 – $57.6m

June 2023 – $60.1m

September 2023 – $62.6m

December 2023 – $63.5m

March 2024 – $87.8m

Current Backlog: In their latest quarter they were awarded $114m in contracts with a $5.7b Pipeline.

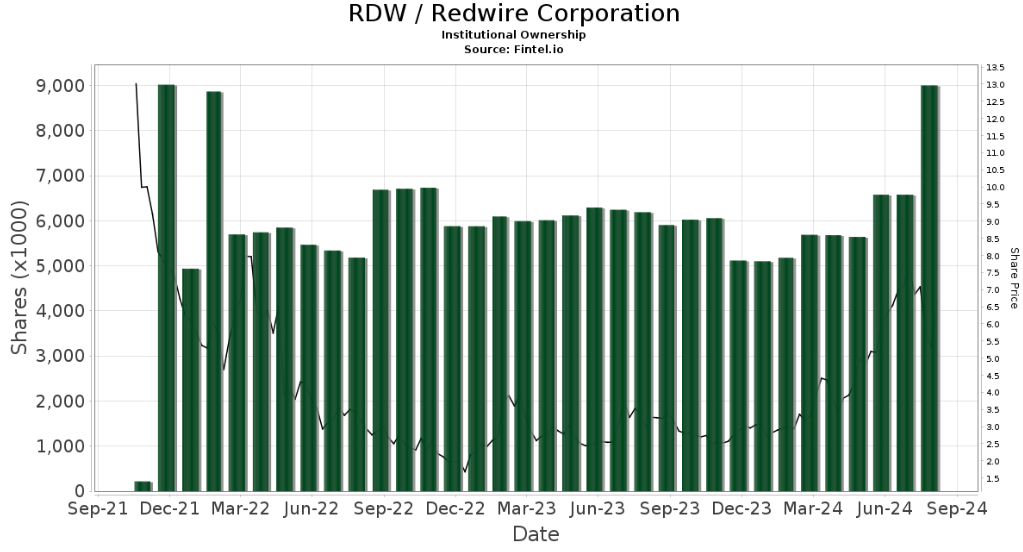

Insider ownership is staggeringly high at 69% with over 10% short. Institutions have also been increasing their overall exposure.

I also feel that once this gets over $500m market cap it’ll trend with ASTS and RKLB on WSB. As $500m market cap is the minimum requirement for it to be posted on there. It’s important to note that a lot of funds and big traders track WSB to see what retail are partaking in. It’s partially why we have seen such big moves in RKLB and ASTS as of late.

The options chain on RDW is also sparse compared to the other two, as people no doubt pile in, due to the lack of liquidity, this could easily start a gamma squeeze.

A lot at play here and a lot to like, I have December calls and shares.

Leave a Reply