A lot of names/sectors continued to pullback yesterday, something to be expected. It would be healthy for multiple sectors to chop for the next 3-6 months here and I feel this is a like scenario.

For the past two years the themes have been AI, Quantum, Space & Some Energy. Yet the biggest and sexiest theme of them all is still yet to run, Robotics.

If you truly think about it, where does advancements in AI, Space, Compute Power and Energy lead too? In my humble opinion, robotics. The TAM, which is always the sexy word on wall street pre sales, is far larger than the AI market itself.

It’s of my opinion, that the robotics theme will put in larger moves than what we’ve just witnessed in those mentioned. The question is, who are the leaders and who are the pure plays.

Something I’ve really come to terms with this year, is even though my performance % wise has been exceptional, I’ve drastically underperformed my thesis plays, AGAIN.

Meaning, I would have made a far larger gain had I done less, traded less & just focused on entering themes/thesis plays once the buy signal is there. Had I of then trailed each trade against the 17ema and sold only on a daily close below, my approximate gain would have equated to 8,000% this year and that’s conservative.

As the saying goes, “hold onto your winners”, which is something I didn’t do a great job of this year. I’ve always preached to not look at the charts intraday and let your trades play out, I clearly need to improve more on this and as a result you’ll notice I’ll be a lot more active pre and post market moving forward. I’ll go into a lot more depth on these matters in my yearly review, including the maths behind it. We’ll then discuss it on a fireside next week.

Back to the robotics theme, SERV OUST BIDU TESLA RR ACHR JOBY are just a few of the “Robotic Names” that fit the theme. I intend to build out a list and analyse the companies one by one, if you have any feel free to tag me in them and I’ll share the list once done.

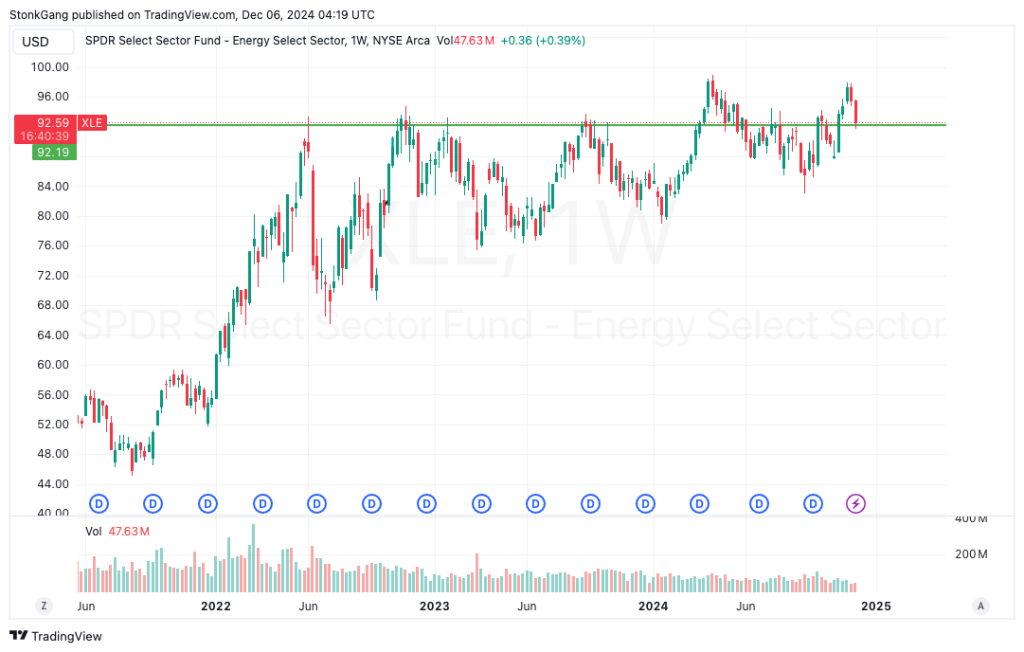

$XLE – I’ve been waiting for this to either pull into $92 for a tight entry or breakout, the market said it would rather pull in. I’ll be watching how this sets up over the next few days and how $92 holds.

$RXRX – The best name in ARKG in terms of sentiment, stability, backing, growth prospects. I play to switch my entire ARKG position into this name. Cathie continues to trade the ETF like a fucking maniac and is ruining the holding structure of the ETF, which was the main reason I bought in the first place.

Aside from that I’m calling it a week to continue reading and will wait for new setups to form, right now there are very few par China.

Leave a Reply