The election, rates, stimulus and big earnings, it’s all happening this week.

It’s also when Biotech generally performs very well and should trump win potentially exceptional.

The implied move of the election is 2-2.5% in SPY, which for underlying names could be enormous swings and volatility.

There are a few overcrowded positions as we head into all this, short oil stocks, short biotech, long small caps, long big tech. So could it be that energy stocks and biotech finally start to outperform?

As you may well know by now, my strength is thinking ahead but it can also be a weakness, as I’m often early to the idea. I personally find it hard to believe that Oil & Gas is done. If we really are on the brink of another “industrial revolution” then our energy output just isn’t large enough. Nuclear will also take 5-10 years, maybe longer, to be built out and meet the requirements. Which means, Oil & Gas demand will soar.

If this doesn’t happen then innovation has surely slowed, the economy has weakened and most sectors underperform… If that’s the case then most sectors have also pulled back..

Given the over-positioning on Short energy stocks this presents a great R/R scenario. The problem is, you really want Oil >$76-78 for a lot of names in XLE to make “good money”. There are many basins which require this price to generate significant FCF and for some to just break even.

Whilst I’m green this year on Trading Genomics and Biotech, I’m of course red on my current new position. Weirdly, I want it to go more red, as this would provide such extremes that the odds are almost certain to be in my favour with leaps. I truthfully don’t think we see it, yet if we do, I’ll triple my exposure.

Now onto China, the biggest $ contributor to my gains of 2024… My thesis has not changed since BABA was in the $60s yet the R/R has. A lot of the options are now expensive and not cheap, the multiples have of course increased significantly in some names too. Meaning it’s a double whammy of reduced R/R principles.

Could the stimulus cause Chinas market to soar? of course.. Problem is a lot of people think that’s going to happen and have positioned for it. So who’s the NET buyer when the news is released.

A better proposition is if the stimulus tanks the market, this leaves funds and retail chasers absolutely screwed. This would also lower the IV and premiums, presenting a much better opportunity. Do I think this will happen? I have no idea, otherwise I would be short into it. It’s not about what I think might happen, it’s about what I would need to happen to get long again.

Names like GOOGL AAPL etc are tying to hint things aren’t as strong as they seem, however they’re not yet classed as bearish either.

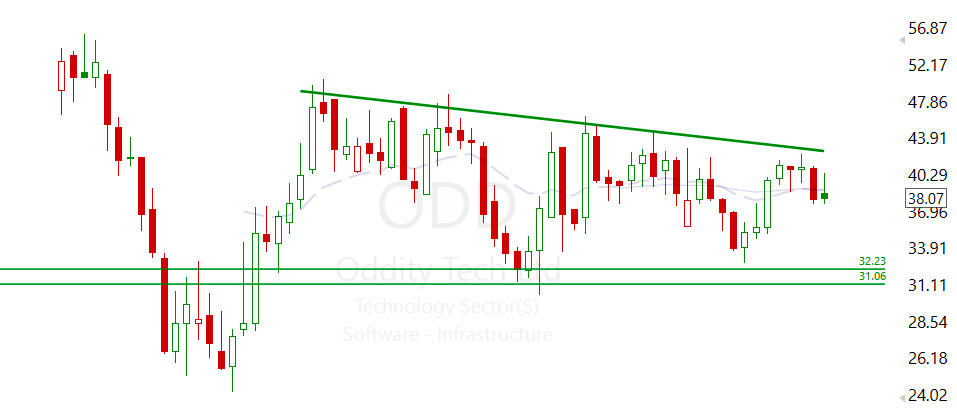

$ODD – Still loving the range build on this one, high growth name, huge market, Israeli based. Annoyingly has earnings in two days but expecting a beat. Options chain even with the high IV is cheap, low liquidity being the reason. A lot of other names in the sector have been beaten, yet this remains in range with super investors adding to their positions.

Aside from that I’m positioned where I want to be for today.. Let’s see what all this noise results in.

Leave a Reply