Chop, chop, chop,

IWM continues to pull back and is now technically bearish, as is XBI. Not something I would short not bet on staying that way, however it shows how messy the market is right now following the rate cuts.

The conditions remain terrible and opportunity remains thin, however, our latest position in OXY looks good so far with aggressive call buying the last couple of days. With the open interest on both short and long dated contracts increasing.

Oil & Gas remains a very under positioned sector for large money and retail, my thoughts here remain the same and I’ll continue to let the trade play out.

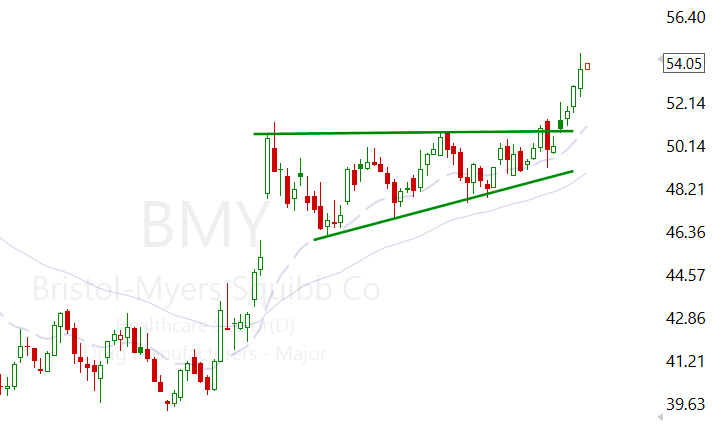

$BMY continues to show extreme relative strength to its sector and the market. The buying yesterday remained extremely aggressive, more data to be released next week.

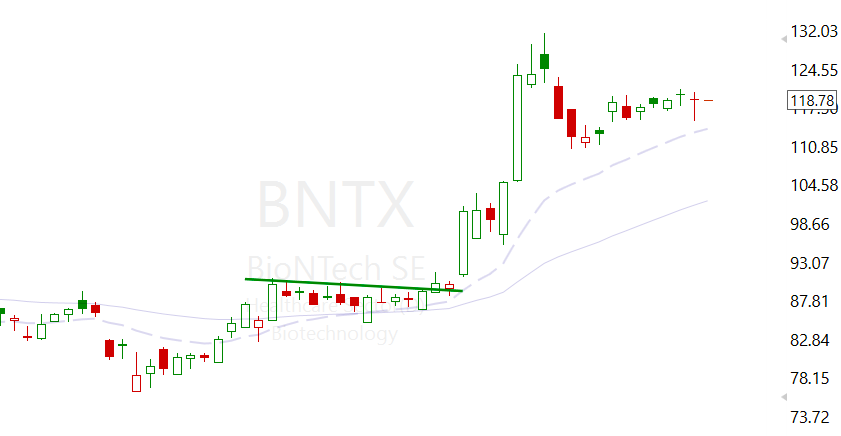

$BNTX – I am really liking this range build here, super tight action with investors refusing to give any back. If XBI can turn this could really pop, tight stop would provide a great R/R opp.

$ODD – I have been tracking this name for quite some time, nice business model and growth, a few super investors keep increasing their position. Trades light and fast so can put in outsized moves. Weekly is start to shape up nicely.

Apart from that the “new” opportunity is few and far between, nows a good time you remind yourself that it only takes one good trade to make a month or even a year. There’s no rush, the market does not care that you want to trade.

I won’t be trading tomorrow so the next watchlist will be next week.

Leave a Reply