Ok, let’s get straight to it. I’ve shared my overall thoughts numerous times over the last few weeks, caught up on reading material & ready to get back to it.

Firstly, lithium names are starting to show some strength the past 4-6 weeks, coming out of a cyclical bear market and forming lovely weekly ranges. Since their previous bull markets a lot of the names have become stronger and more well-developed this time around.

$ALB – Nice reclaim of the weekly EMA and pivot, a recent miss on earnings was bought up and immediately recovered. Both weekly and daily look ready to head higher.

$LAC – Nicely deleveraged trading at Enterprise value, attracts a lot of volume.

Weekly:

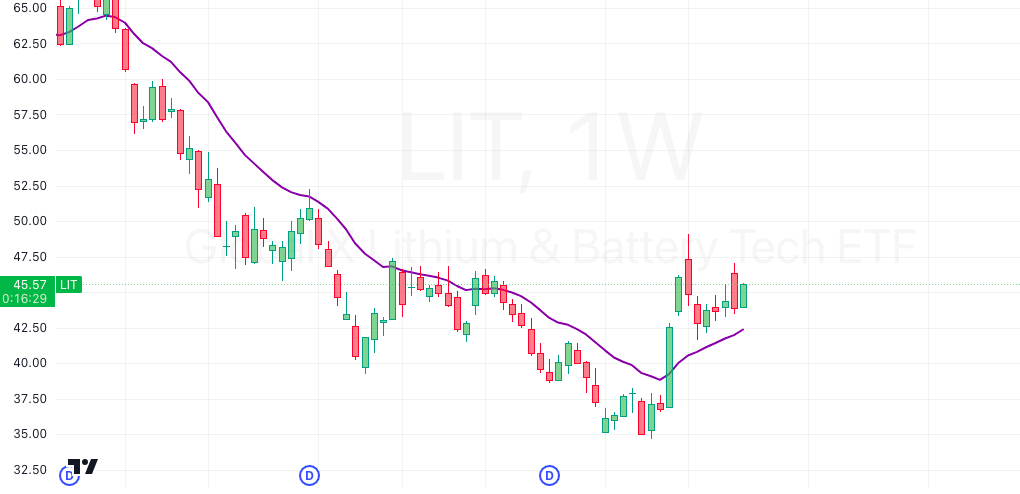

$LIT – Lithium and battery tech ETF, broken out from lows and holding well similar to the individual holdings.

$XOM – Looks ready to break out of a huge weekly base as multiple oil and gas names are starting to show strength, They did well under previous trump administration and I can see them doing well once again.

$MBLY – Bottom looks to be in with a nice bottom breakout and 3-4 weeks of consolidation. Meanwhile other semis continue to get slapped, very interesting relative strength and strong recent earnings.

Daily, $16 a nice level to risk off.

Leave a Reply