Weekend thoughts:

I feel most investors/traders are suffering from recency bias and therefore expecting some kind of heavy pullback following this steep rally from lows. The problem with market data is it allows ones bias to perceive it in any manner. In just 1.7 years QQQ has rallied a staggering 85%, the data point most perma bears use to warrant their decision making, yet in the past 2.8 years we are only up 18%. So was the sell off simply unwarranted and in reality we’re just at the beginning of a bull market, or have we rallied 85% from fair value levels. A few of the traders I like, and there aren’t many, are calling this the most hated bull market ever as most are under-positioned and/or missed the move completely; I agree.

If it were possible to group all the losing traders and bet against them, would you? Of course you would, you’re essentially getting a guaranteed return.

I’ve had a few questions and lengthy discussions regarding the above. The most common question “How do breakouts work, which require many people to have the same belief, if most people lose money”.

That’s a good and very fair question.

I answer this with another question, does every breakout work?

The response is obviously a resounding no.

For a breakout to work you need people who believe in the opposite outcome, who are beating against you. You need people who are short, people on the sidelines, people who will chase and people who will be infuriated with the outcome you desire.

The run in NVDA is a great example and one I’d like to bring up, as I was wrong (I know, I know, it happens). I remember the gap up to $300 following NVDAs earning beat, I actually laughed and my initial thought “Look at all these people chasing NVDA, what a bunch of fucking clowns”…. It topped at $1,500.

Now, how many do you think were betting against it at 300 fuelling the rally higher, and how many people do you think chased at 1,000 vs 300? The answer is A LOT. If everybody were long into the $300 print there would be no net buyers and it would fade.

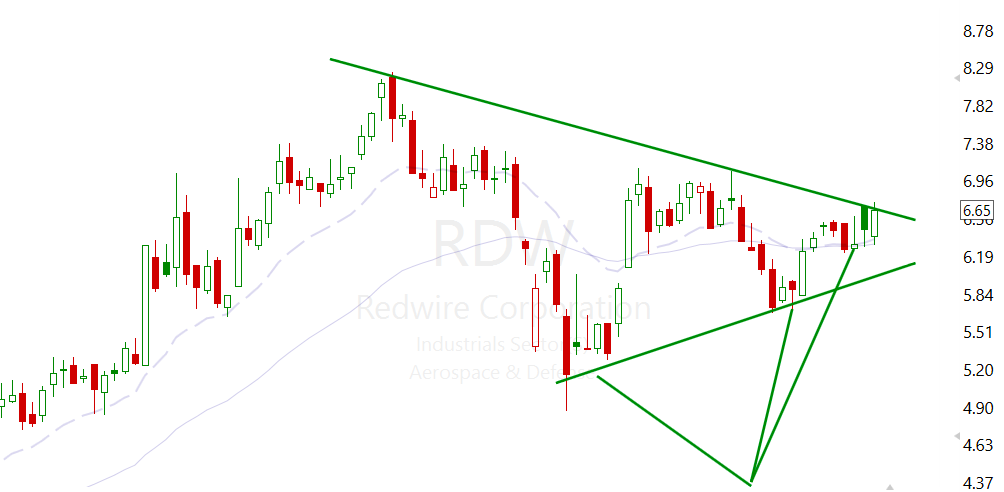

Let’s take RDW for an example, a space name very overlooked with low liquidity and a micro cap. For most institutional investors it’s too small and too illiquid to invest in, so they’re out. Let’s say 7/10 people who are interested in space stocks are fully invested in RKLB and ASTS, so they’re out. Most retail traders are focused on twitters bear porn so they’re out. Those who chased the the gap up 3.3 months ago have lost patience, sold and gone elsewhere so they’re out. So who is left, I actually want you to stop reading and think for a second.

In this scenario you have a few die hard fans, a few small funds and angel investors. Then your usual stocktwits retail who get in and out, in and out, in erratic behaviour. Do you think those left are eager to sell? Given the timeframe it’s more than likely they’re the opposite.

The above picture is from twitter, a guy I know whom is incredibly excited about the Space sector as a whole. Do you really believe that somebody who went through the effort to have these signs made (I kind of want one 😂) will sell if it pops 20%?

No, if anything it could run 1,000% and he’ll tell you it’s just the beginning (no disrespect in this case).

So when you have a lovely bull flag that people are taught to look for, what one do you think works. The one where 90% of people are still yet to get in or the one where 90% are already in.

The answer should be somewhat obvious, yet for Masses it’s not something they ever consider. You have the people who gave up and sold who will want back in, you have the people who know the bull thesis yet never took a position. It crosses $500m and a few funds are approved to invest, so now they want in. Some of those investors who chased ASTS suddenly see this moving and yet ASTS remain stagnant, so they want in. In starts trending on twitter and a few more pile in, it appears on CNBC and your mum and pop investors want in. This allows for a constant steam of buyers > sellers and thereby allowing a breakout to work.

This is what I mean by betting against the losing traders, as in, not short everything they touch but when they’re all crowding into SMCI at $1,200 (Literally one of the most ridiculous things I’ve ever seen in 14 years), you may want to avoid that potential “bull flag setup”.

So when I look at the market right now I ask myself where we are, a lot of retail are calling for a massive recession, a lot of funds are deleveraging and exciting the equity markets, JP Morgan and others calling for a 5-10 year chop period. Most people who I speak too that are uninvolved in the markets and ask “how is work going” discuss the apparent massive recession they’re hearing on the TV, the stagnant real estate market etc and so forth.

Now I’m not saying QQQ and SPY etc are just going to shred, they’re still massively over-exposed. The amount of qualified financial advisors who just invest in 5-10 index funds is embarrassing and in my opinion daylight robbery (Let’s not go there).

However, there are many sectors and names massively under-exposed. Of which are showing huge growth numbers and levels of innovation we haven’t seen in quite some years. Initially when people bet against such sectors it can cause a lot of volatility, doubt amongst bulls and confidence in those with bearish bets.

This then causes asymmetrical bets, ones where you get odds that in reality you shouldn’t be getting if the markets were in fact effiecent. Such bets are the reason for my ludicrous returns, however, they are few and far between and require you to go big when it matters.

Until you accept that trading in such a manner requires many to either think you’re wrong or simply ignoring you no matter how loud you shout and scream, you’ll struggle to hold for the outcome.

So as we head into next week just remember this, positioning of the mass matters more than any data point, period, full fucking stop.

Something else I want you to consider is why should a name increase in value in the first place?

If I offered you a 10% share in a hotel I own for that generates £500,000 FCF a year for £100,000 would you take it? Would you take the risk that a single location holds for a 5% return?, I wouldn’t.

What If a new location was expected to open every 3 months with the same expected FCF? Well now it’s exciting, there are risk those hotels won’t be as full as the the projected numbers but if they are the £100,000 would be an absolute bargain. As the amount of FCF increases what if they could then open a new location every month?

Then what if after 5 years of expansion they issues the FCF payments to shareholders? Your £100,000 investment could net you a yearly payment of £200,000/year in a matter of 5 years.

The growth and potential growth of a company is eventually what dictates its price, sentiment on whether they’ll achieve that or not changes. Over a long enough period FCF will prevail, something I shout about often.

Now lets mix those two up, what happens when you have an under-positioned name and sentiment on their growth is low? If a genie told you the chances of those hotels opening and operating successfully were 80% would you take it? Your answer better be yes and best slap 10% of your capital into it.

These are what I consider A+ setups, a nice technical pattern that everybody whose read “how to make money in stocks” will chase, a name that the crowd is oblivious too yet will trip head over hills for like Megan Fox in transformers. A name where people think their pick in the same sector is the better one, until they can’t handle it anymore and FOMO in. A name where good traders keep an eye on it yet miss the entry, ever so eager to buy the next period of consolidation.

You get the picture… You want to get positioned in a period of time where everybody is going to want it, they just don’t know it yet. Your entry is the first domino, the momentum increases exponentially as the next domino falls.

The moment the masses are in the same position you best run, the laws of supply and demand and the laws mathematics themselves dictate its over.

Leave a Reply