Strong gap up yesterday with IWM leading at 3% pre market, followed by some extremely strong fades. Whilst IWM reclaimed most of this move, many did not, creating a lot of stuffed setups.

I feel it’s extremely plausible that as a whole the market just chops here, QQQ, SPY XBI all look bullish but recent moves would favour some consolidation and I think chasers need to be slapped and volatility spilt.

I would expect the less crowded sectors to outperform, XBI > QQQ for example and my preference ARKG > XBI. The market is not giving signals for a broad rally, similar to the rest of the year. Stock selection is likely to be key and just slamming IWM because rates are lower will likely be a far lower return idea.

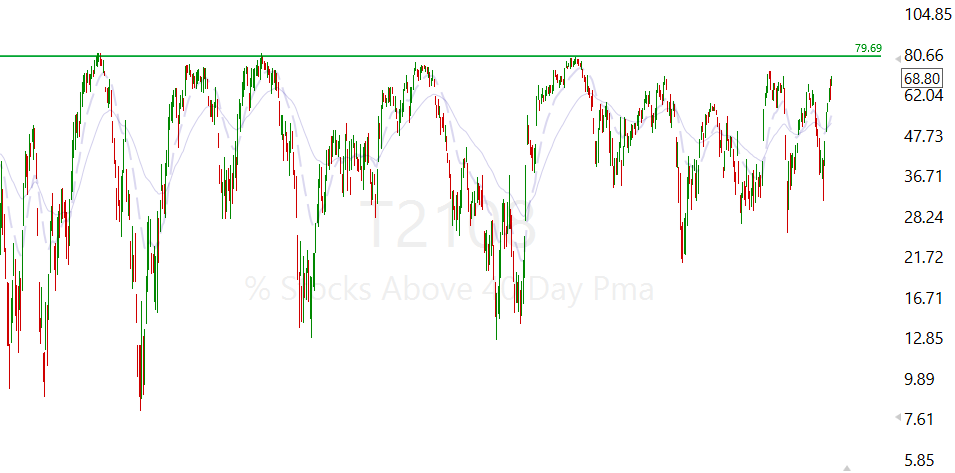

The number of names over their 40 day moving average is already towards highs.

The 4week new high/new low index is close to 100/100, with the most common outcome being a pullback in multiple asset classes. It DOESN’T mean everything fades, just means it’s more likely a majority will.

China remained strong and my thesis continues to play out nicely, manage your positions how you see fit. I have a couple of short expiry options that’ll I’ll cash in today. Yet will hold all of the calls with at least 60 days + remaining, this is more from a risk management perspective than a “I think the move is finished”.

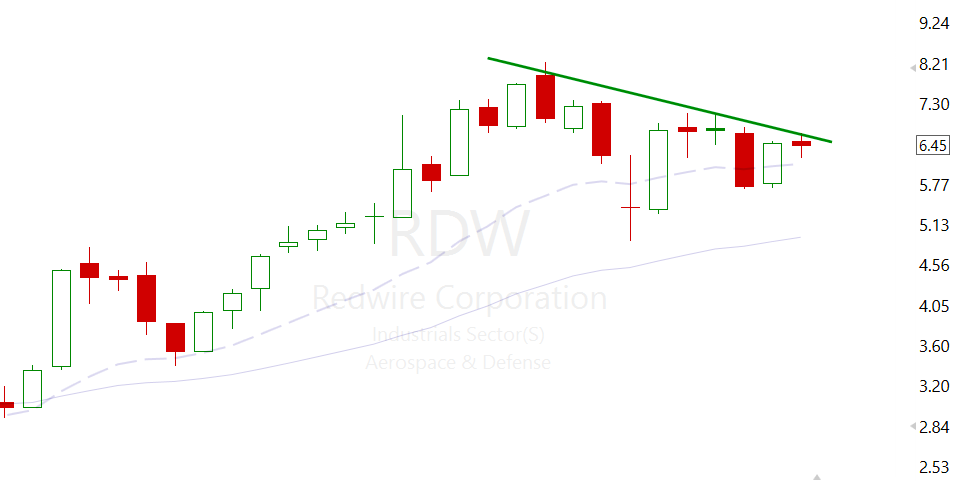

I’ve gone over a lot of charts this morning and RDW still remains my favourite setup. It’s in a strong sector, with a strong weekly flag, under-crowded, low float, low market cap and high growth. My only concern, if you can call it that, is their low cash positioning following the recent acquisition could trigger an offering.

Note: They’ve also just added May 2025 expiry to their options chain.

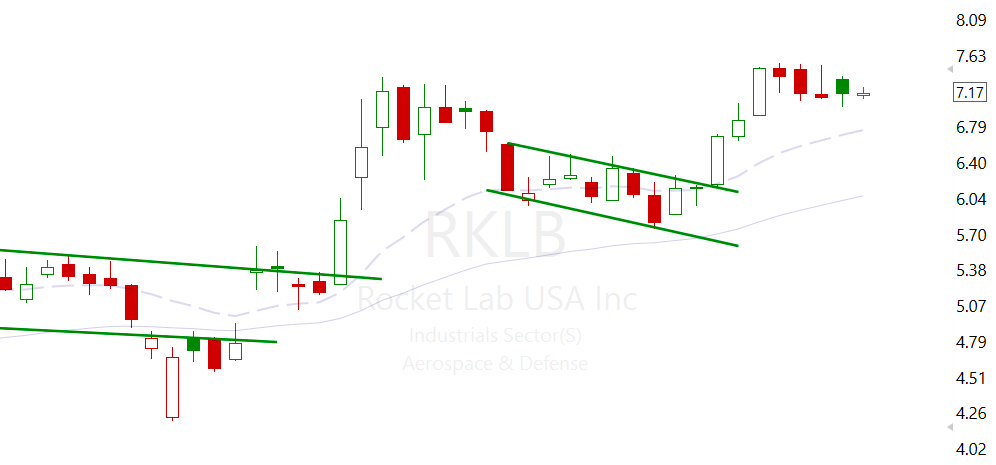

RKLB daily also looking good for a re-entry.

It’s been a long time since I had loads of names I like on watch. Setups have been few and far between for 8 weeks now and given current data points it doesn’t look like that’s improving any time soon. So it’s paramount to really be tuned in and taking the good opportunities with reasonable size.

Just a reminder, do you remember all those times during your trading career that massive opportunity presented itself, yet you were too heavily positioned in Bs and Cs to take advantage of an A+?

You know the drill, you’re in 5-6 positions and the market pulls back pushing them all red. Then a killer setup appears and you’d have to realise a large loss just to free the capital to take it? You can’t emotionally handle that, so you sit in stagnant names and watch the A+ steam ahead.

Never get yourself in that position, you get there by thinking you shoulda, woulda, coulda been in XYZ. Then take less quality setups to feel like you’re a part of the action.

Just wait for the A+ setups and leave the shit for everybody else.

Blue sky thoughts:

Funds are getting heavily short energy and energy names, retail are not long energy names as too focused elsewhere, Microsoft and other fortune 100 companies energy demands are increasing yet the only person buying energy is buffet. Going to dig through the names later today.

Leave a Reply