The fed cut rates 50bps and china followed suit as predicted, we want to see active stimulus measures announced over the next few days/weeks.

IWM is now pushing a 10% move from lows in 7 days, a very impressive feat. Some consolidation and chop here is likely. If we steam higher for another 2-3 sessions I’ll be forced to trim some positions.

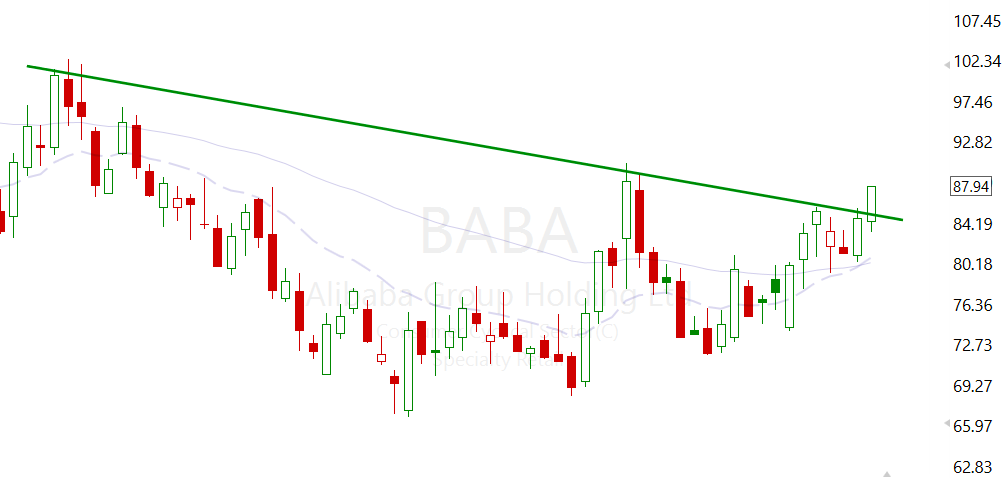

BABA finally try to break out of this weekly range, I would assume most traders are at the brink of breaking point, meaning they’re likely to dump into this China gap up, so expect some volatility. I for one will not even entertain the idea of selling just as the weekly breaks out, if we fade we fade, so be it.

KWEB still hasn’t even reached the weekly pivot point, we’re super early to this idea so again, no reason to sell and if it fades, so be it.

If my thesis is correct this is the very beginning of the move.

ARKG is just trying to peep over that weekly breakout, I still stand by the fact that ARKG is a perfect sector for rate cuts. So far the reaction has been a little muted, nobody is really paying attention. Wouldn’t be surprised to see a delayed reaction.

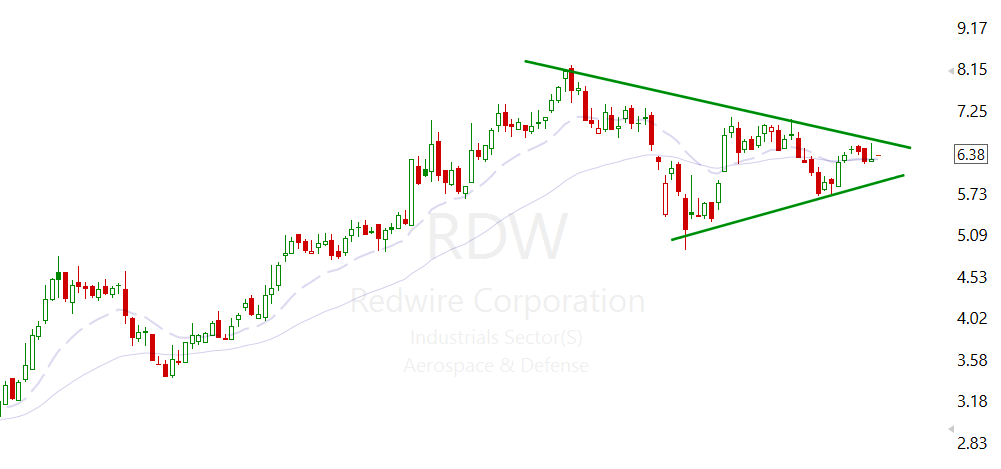

The move on LUNR highlights just how aggressive $RDW and $RKLB could move on any large updates/contracts, specifically RDW. I am still under the impression that once RDW exceeds a 500m market cap and enters the real of WSB and other retail investors, it’ll quickly become a hot favourite. The tradable float is so slim that the moves will be completely outsized.

The chart also looks fantastic, given the Space hype is only just getting warm this is a nice entry point.

Conclusion: Potentially add to RDW then close the laptop, this is very early innings if my thesis is correct. I want to see at least a 3-5 day move or 3-5 ADR rip before trimming/closing out any position. I believe a lot of people will not trust the move and a lot will sell into this first gap up, so expect some initial chop. After which I’d like to see a clean trend emerge.

Leave a Reply