**Current Themes on Watch**

AI Biotech (ARKG, RXRX, PRME etc) ARKG still showing a lot of weakness, it’s now in a daily and weekly downtrend and therefore my thoughts remain the same. We either need capitulation or a flip to bullish trend, no in-between.

Robotics (OUST, SYM, TESLA, SERV etc) Retail are still loving RR, a reminder that the story is often all that matters. The more I think about this as a sector there are only a few names which have proven to manufacturer at mass scale TSLA, SYM, IRBT. IRBT of course being the weakest both fundamentally and technically.

Space (RDW, RKLB) Same thoughts really, nothing to do here but wait, I have my shares and only wish I had more size.

Energy (XLE, Natural Gas, Coal, Oil, Batteries) XLE capitulated below daily extensions yesterday, nice daily candles put in across the board. Starting to see a bid in battery tech stocks like QS, EOSE etc. I class this as an energy play and remain monitoring all possibilities.

**Current Leading Names**

PLTR, AMZN, PLTR, IONQ, RGTI, CEG, SERV

**Names on watch for new entry or add**

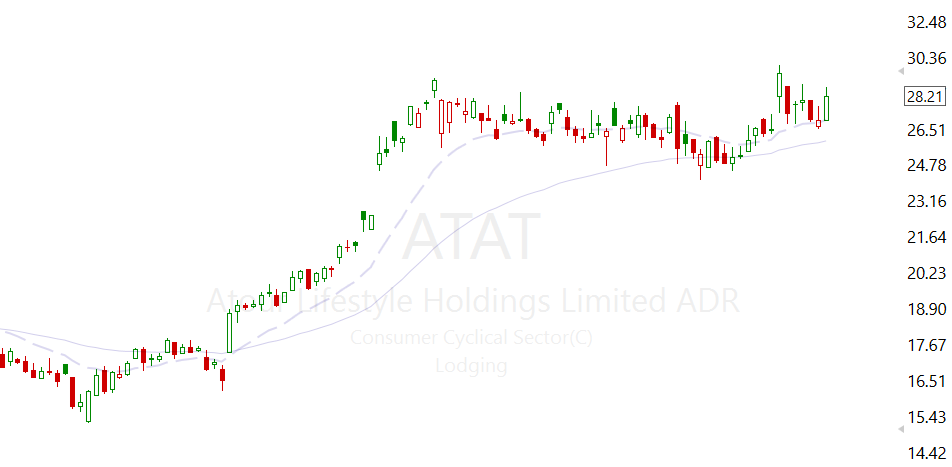

$ATAT – Add on a break of $29.30

**Names to research:**

LUNR – Hicks recommended as a potential Robotic play, need to research thoroughly.

IRBT – Is the company able to come back from this mess? They’ve proven their capabilities on a lot of other fronts, yet statistically, most names companies go bankrupt at this stage.

DADA – Do I want a long term position… Needs thoroughly researching.

** Daily Brief**

The Mag-7 continue their rise and Quantum names said “fuck your puts”. People are furious by the move, touting the investors as “morons”. The funny part is, Im the moron for missing the move and so are they.

XLE went straight below capitulation levels and bounced, my thoughts obviously remain the same and I will continue to remind myself of the fact “There is no revolution without energy expansion”.

I’ve purposely structured my watchlists a little more formal as of late, this is to help me remain focused on the current and potential upcoming themes, as I complete refuse to miss one again.

China… Whilst HK50 got slapped below the stimulus level and whilst investors who chased got burnt for the 100th time, the retail sector in China seems to be calling bullshit. China has managed to keep its currency stable throughout this entire period which is pretty impressive, fluctuating only a couple of percent. It’s growth numbers actually look pretty strong and fundamentally are nowhere near as bad as wall street will have you believe and internally have made themselves believe. The “market” is calling bullshit on the consumer being weak.

$YUMC – One of Chinas largest restaurant chains.

$ATAT – One of Chinas fastest growing hotel chains.

A lot of the retail favourites like BABA & JD seem to be so crowded that traders and investors are tripping over each other. The less crowded names above are painting a clearer picture.

In my opinion, China has got to the point where taking a few long term positions (investments) is worthwhile.

In terms of new setups, again, very few and far between. Letting current positions play out. Researching a broad host of energy names and tech.

Leave a Reply