This week finally leads us to a big market catalyst, the first potential rate cut in 4 years. Whilst there are many theories as to how this is going to effect the markets both short and medium term, it’s likely rate sensitive sectors gain an initial boost.

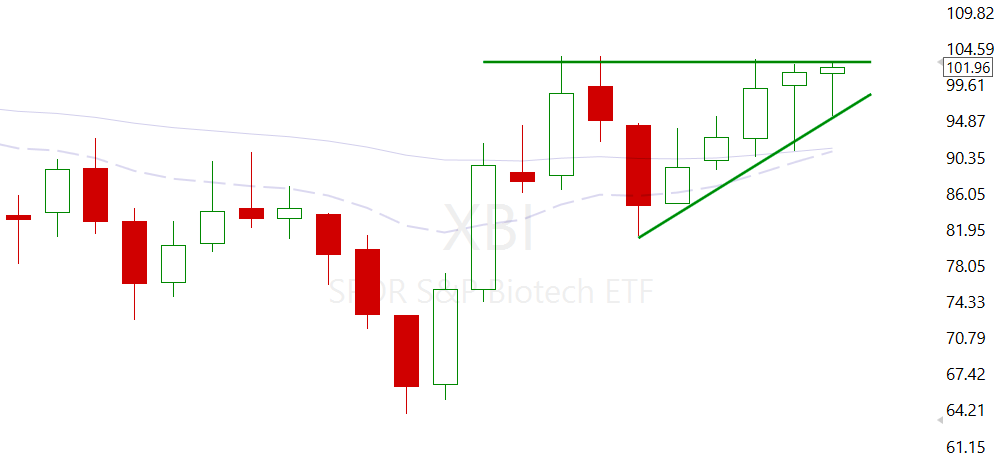

Friday we saw some very aggressive action in some of the Biotech names like $BNTX $CRSP $BEAM $NTLA with market breadth overall improving. Biotech remains one of the most rate sensitive sectors and for good reason, the XBI bull flag looks fantastic.

China lagged again last week behind US equities, as the news cycle continues to deteriorate. It’s now been 70 weeks of continuous outflows from China equities across the globe, yeah BABA after joining the southbound connect programme received $16b on inflow from China mainland investors, pretty impressive.

Interbank rates are collapsing as it becomes likely that China will announce a rate cut in the next week or too. Whilst data, which is always delayed, still continue to get worse. It seems there are finally some aggressive efforts to stabilise and boost the local economy. As far as I see it, all of the bad data, news and exit of funds reaches extremes, the bull thesis becomes even more compelling. Individual names such as Meituan, continue to receive upgrades, the latest a BBB+ outlook from S&P, citing a positive outlook.

Regarding the ARKG idea I’ll be posting my thoughts shortly.

Apple sales for the iPhone 16 were disappointing yet in my opinion expected. There has been a massive lack of innovation providing little reason to upgrade (in my opinion).

Space continues to look great with RKLB pushing out this monthly range and RDW tightening up.

IONQ noticeable weekly pivot with the news flow turning more positive. Whilst these can take a few weeks to consolidate it shows some strength in the Quantum computing space leader.

Regarding BNTX, this is a prime example of when I micro manage. I wrote an entire thesis on why this exact thing would take place and how the options chain was under-priced. The fact I am not in is frankly hilarious and a deep reminder of why we don’t watch the charts. Based on my sizing that would have been approx 200% account gain, all I had to do was simply do less.

I bring this up as it’s something I preach. Most traders find it extremely difficult to do nothing, to step away from the charts and let things play out. Thereby harassing small wins and big losses. The intraday and even intra-weekly price action is often meaningless unless a sell rule is hit. I wrote a little reminder on this here: https://stonkgang.com/your-emotions-keep-you-poor/

I often get accused of not “paying attention” or “getting lazy”, the truth is the opposite. I force myself to go and do something else in order to make substantially higher returns than the average profitable trader. $BNTX is an example of when I failed to do so.

Looking at this week there’s very little I need to partake in until after the rate cut. I’m positioned for it and should my thesis play out, the profits will be huge. However, if I a wrong, I need to make sure I’m not too heavily positioned.

So my plan today is finish a writeup I’m working on, them I’m heading out to let it play out.

Leave a Reply