**Current Themes on Watch**

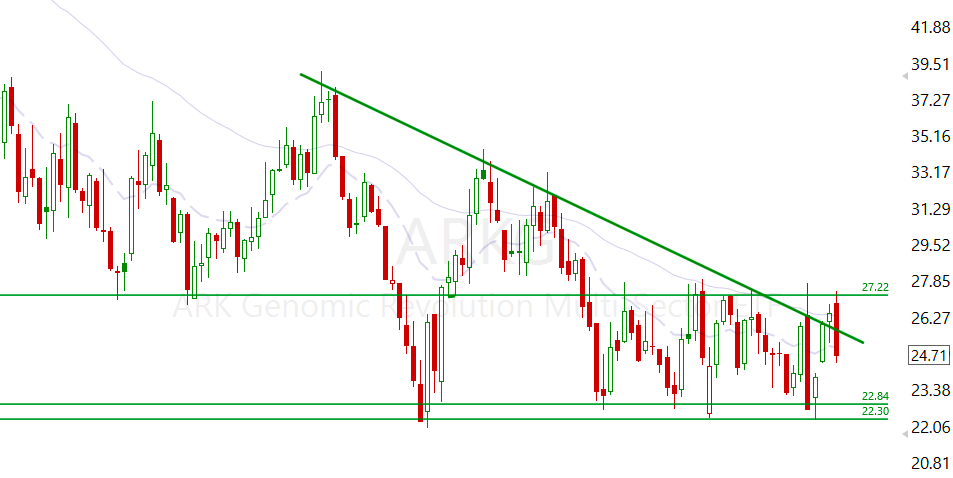

AI Biotech (ARKG, RXRX, PRME etc) Gene Editing/The AI of Biotech remain on watch. For now we’re still seeing a lot of weakness in the sector as it builds a stage 1 base. It either needs to head back the breakout zone or below this support for capitulation. There’s no point buying between the lines.

Robotics (OUST, SYM, TESLA, SERV etc) I am still researching the best play to play this and continue to search for names to add to the list. Still struggling to find pure plays which is a shame, waiting for more companies to spend then R&D in robotics.

Space (RDW, RKLB) consolidated and moved on Friday, unfortunately I was not able to take a position. The weeklies are still stretched and so I’ll remain patient to get an add back on. This is the issue with selling a leading name once you feel it’s extended, it’s hard to get back in.

**Names on watch for new entry or add**

$ATAT – Add on a break of $29.30

Buy PRME in fat pitch if it capitulates.

**Names to research:** (Random tickers that have appeared in my scans, It may be a new name or finding the reason for a recent move)

DDD (3D printing hasn’t moved in years, why is this popping), ZENA, ZJK, SBLK (What slapped the shipping sector and when does it become deep value), SOC, AESI (I want to know why this Oil & Gas IPO is so strong), SARO, BKKT, PDCO (why did it move),

** Daily Brief**

Some blue sky thoughts here, just like TSLA I can see other EV manufacturers using their tech advancements and manufacturing capabilities to break into other market segments, especially robotics. It makes perfect sense for such companies yet depends on management having the foresight.

If you were to watch a video on NIOs factory and manufacturing process, you’d see exactly where I’m going with this.. Robotics is not really a theme yet so an announcement would not move the stock by much if at all, will keep my ear to the wall. If I had it my way I’d pick NIO to make this move as it’s manufacturing process remains a work of art.

Anyways, a lot of the leading names are starting to show signs of weakness and some swiftly entering downtrends. Market breadth Continues to deteriorate whilst the Mag-7 reach new extensions. Shipping, Steel and Energy is indicating that an economic slowdown is on its way.

Chinese investors are pissed after the meeting gets pushed to March 2025. To date, most of Chinas stimulus announcements are empty promises. Names like BABA continue to behave poorly as does the index HS50, there are a handful of names like TIGR ZK & JKS showing relative strength. I’ll be tracking this for breakouts once the time comes.

There are a few nice setups in US equities yet they remain rare. Market volumes are likely to start decreasing at this point and therefore the chop may increase. It’s unlikely I change any positions this week, just sit tight and let things play out.

CRSP now heading for daily extension yet the rest of the sector is not quite there, names like PRME, ARKG, BEAM, RXRX would need a total washout to make this trade have a good R/R. So still waiting for things to crack further, or should I say, hoping things crack further.

As OUST yanked back, INVZ the retail favourite is taking the lead, they’re much further behind yet that often doesn’t matter. Another company worth looking into.

$ONDS – I still need to finish investigating this name and you may remember us trading it in 2022. It seems they’ve made some great advancements in their tech, received military orders for their defence drones etc. It’s been getting a lot of volume recently.. No entry here but will take the time to research this week.

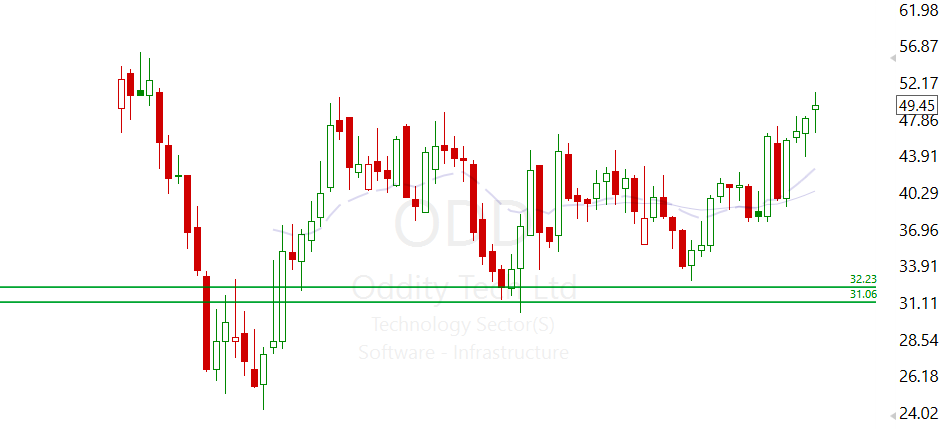

$ODD -I’ve liked this name for some time and glad I haven’t bought into the basing as it’s taken a LOT longer than expected. Finally beginning to head towards ATH. If it can tighten here I’ll attempt to gain an entry. Nice sector, strong growth, a few super investors are fans, makeup sector (We’ve seen what ELF etc can do).

$ZK – Still a ridiculously strong IPO, does not seem to care what the China market is doing. Ideally goes sideways some more, I’m watching this as a leading indicator. Does it break out as China bounces.

**Current Positions:**

I see no reason to exit any current positions, my main (TIGR VNET OUST SERV & JKS) are just chilling. Respecting weekly levels and still attracting a strong bid, so all I can do here is wait.

Leave a Reply