**Weekly Trend:**

**SPY:** :small_red_triangle_down: **QQQ:** Uptrend **XLE:** :green_square: **ARKG:** :small_red_triangle_down: **IWM:** :small_red_triangle_down: **TAN:** :small_red_triangle_down:

**Current Themes on Watch**

AI Biotech (ARKG, RXRX, PRME etc) Still remains in chop and weaker to other sectors, including IWM. Biotech is already down 4% YTD and most weighted holdings in XBI look like they want lower. I remain waiting for the day these names pivot on the weekly.

Robotics (OUST, SYM, TESLA, SERV etc) ROK, SYM, ARBE, SERV, OUST, RR all with a little green on the day.

Energy (XLE, Natural Gas, Coal, Oil, Plug) Once again leading the market YTD, a strong bid continues. Nothing to do here except let the trade play out.

China (KWEB, BABA, JD, BIDU etc) Strong gap and hold following more stimulus talks, it will be nice to get this Inauguration over with and for trump to start backtracking on his policies. Still waiting for daily and weekly trends to flip bullish.

**Names on watch for new entry or add (dependant on market)**

N/A

**Names added/removed from In Focus List**

None. (updated 15th Jan 2025)

**Names currently flagged:**

VECO, FORM, AAOI, CRDO, UGI, MIDD, WB, STNE, NOG (Need to research all three in depth).

**Daily Brief:**

XLE continues to lead the SP500 YTD with Natural Gas the supreme leader. EQT and LNG showing the rest of the Oil & Gas names how it’s done. Impressive price action all round.

Semis still with the weakness and basically all key names in a downtrend, this no doubt puts a dampener on names like ARB & INDI. I’m watching the entire sector to Gauge when to increase my overall exposure to those two.

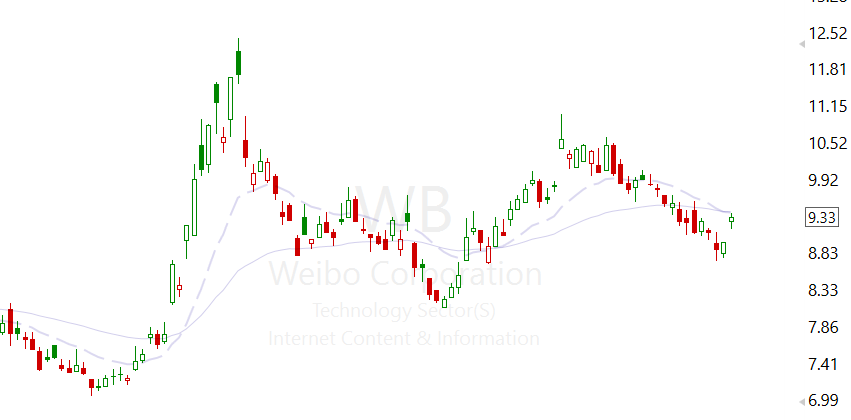

China nice little bump following the stimulus news yet it’s important to remember we remain in a weekly and daily downtrend. KWEB needs to reclaim $29.50 until any real progress is witnessed. As mentioned briefly above and on many occasions, once trump has gone through his inauguration I believe the Chinese market will flip more bullish. You can’t just tariff everything unless you want to destroy americas supply chain and 40% of SPYs earnings. Looking at the options, it’s clear that most bullish on China are taking the safe route by parking into KWEB and whilst I obviously like the play, it’ll likely be the less obvious and more over-looked names that come out ahead in the end. Names like WB, YRD etc etc. Most of my reading time consists of looking over the Chinese small caps, once I start purchasing what I believe to be the best prospects I’ll let you know.

Quantum names with the bounce, mainly RGTI. These names are trading with incredible volatility, very impressive price action. I had no interest yesterday and still no interest here. The IV on those options are juiced, still researching the pick and shovel plays for this sector.

Banks & Payment processors remain strong, KRE attaching some interesting call buys. Again though, no interest for me in this sector.

All the battery tech names are now in a downtrend, so again, little to do here.

Cyber security names still in a daily downtrend.

Almost all restaurants, consumer staples

IWM currently being held up by KRE the past 2 days, in reality there’s little money flowing into these small cap sectors.

Gold & Silver miners just starting to catch a bid, HL CDE GFI all nice moves yesterday. Still eyeing silver for an entry but it doesn’t look ready just yet.

All in all, I see very little for more to do here for swings.

**Shorter Term Trades**

Quite a few charts setting up for some nice 3-5 days:

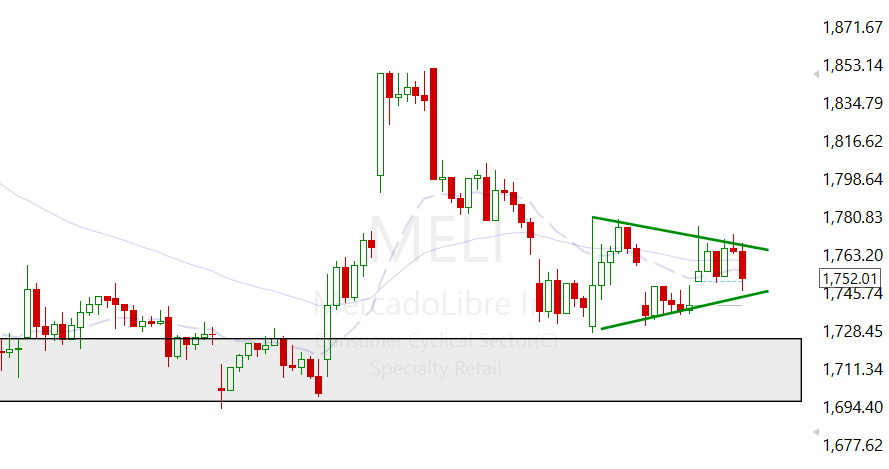

**$MELI** It’s holding that huge weekly breakout and retest well, Elon and Trump have expressed their intentions with Latin America on multiple occasions. This could be a far less talked about trade for the Trump Inauguration. Thanks to the MELI options inherently low IV a pop here could print high multiples.

If we breakout away from the Grey Box (weekly buy zone). You could see a nice R/R of 10/15-1

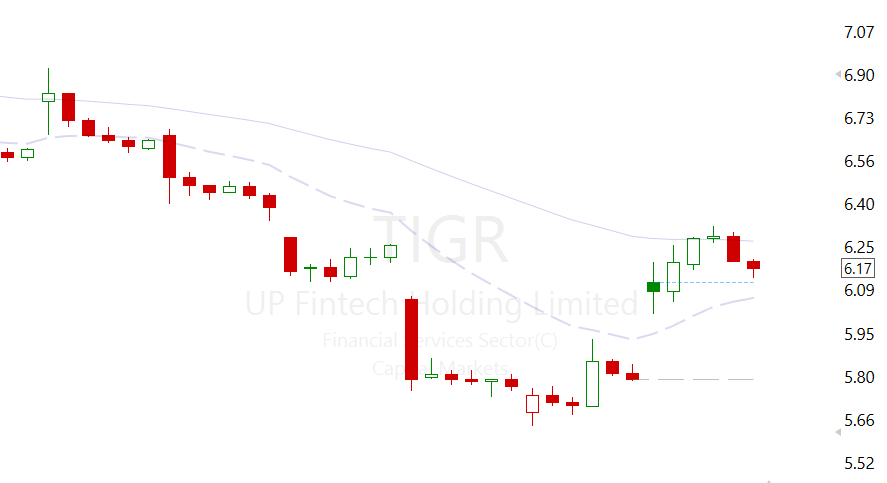

**TIGR** A lot of open interest on this one and a nice 65 min pivot, last time this equated for a 48% move in 10 days.

$JKS – If there’s a time to take risk on this idea it’s now, with China catching a bid and TAN trying to keep its head above water meanwhile JKS tests the bull flag to the downside. $25 strikes are cheap and provide a LOT of leverage here.

**$UGI** Under the Radar Gas provider, the chart is ridiculously bullish and the options chain with its 32% IV is not pricing in the explosive move that could take place here. Very nice R/R setup given the backdrop of the market.

**$WB** Another china name not talked about much, trades at just 6 P/E with a strong chart and a massive beneficiary on any Tik Tok news. Daily is attempting to pivot and again given the market backdrop could get moving.

$ARBE – Still eyeing that $2.50 spot for the re-add here.

Leave a Reply