**Weekly Trend:**

**SPY:** Downtrend **QQQ:** Uptrend **XLE:** Downtrend **ARKG:** Downtrend

**Current Themes on Watch**

AI Biotech (ARKG, RXRX, PRME etc) Strong recovery after a very week opening, CRSP and RXRX really stand out considering each where down significantly in the first half of trading. Still stuck in a range of chop leaving little to do here, at the very minimum we need to see some daily pivot candles.

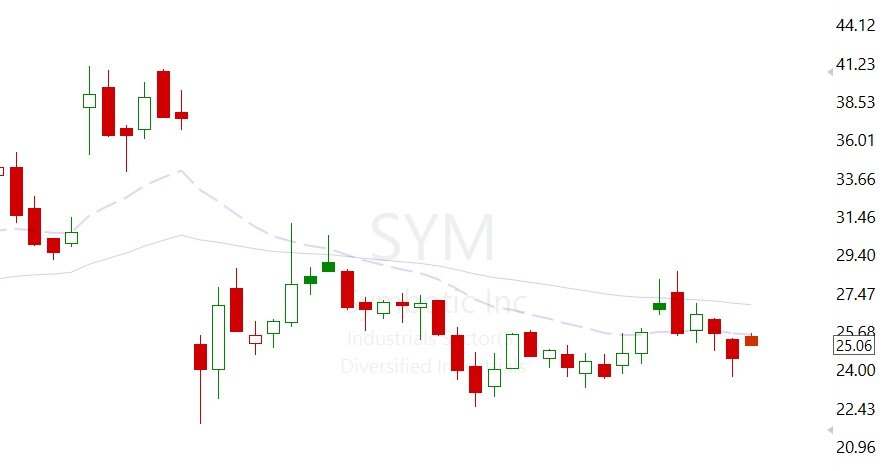

Robotics (OUST, SYM, TESLA, SERV etc) The flushes continue with multiple names dropping a further 20%, I could not be more grateful for this kind of price action. Chasers annihilated and trapped, setting the stage for a lovely secondary entry.

Energy (XLE, Natural Gas, Coal, Oil, Plug) Continues to lead the market so far this year, strong price action across the board, little to do here except let those long term entries play out.

China (KWEB, BABA, JD, BIDU etc) China capitulated with its 4th day of straight Algo selling, creating a nice opportunity to get long. Honestly, I cannot believe the amount of opportunity China has provided in the past 18 months, it’s outrageous. If we can holdd this 65 min pivot I’ll look for a spot to add.

**Names on watch for new entry or add (dependant on market)**

ARBE $2.80 & Sell $2.50 puts.

**Names added/removed from In Focus List**

None. (updated 14th Jan 2025)

**Names currently flagged:**

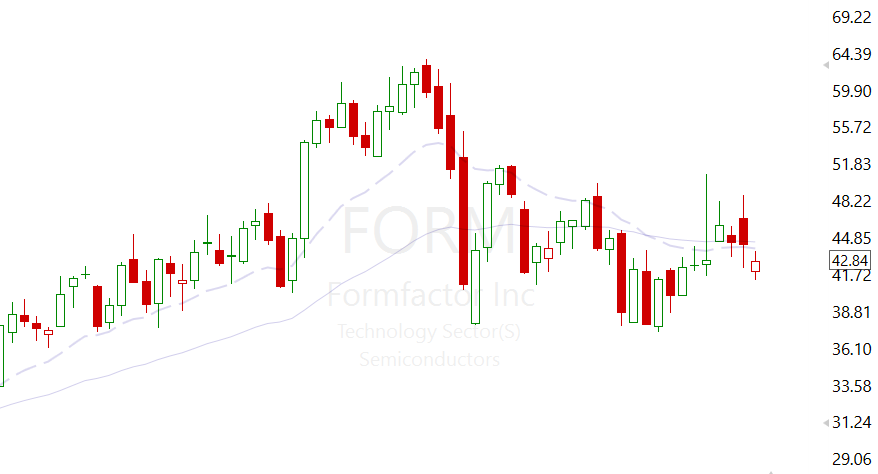

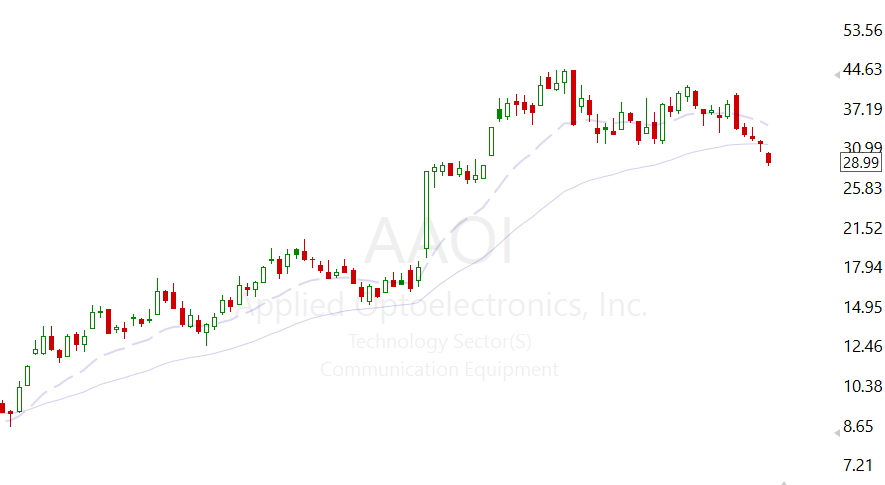

VECO, FORM, AAOI (Need to research all three in depth).

**Daily Brief:**

Many names and sectors capitulated yesterday with Quantum the leader in this regard. Some are already down 75% from recent highs that were only put in 4 days ago. Truthfully, some of the wildest price action I’ve ever seen and glorious at that.

A couple of names that could be key winners and get picked up as Quantum plays are FORM, VECO & AAOI. I have them shortlisted and will look into each company further.

My thinking… A lot of the Quantum names (not all) that ripped the past few weeks/months were garbage and years away from providing any real value. Do we now see investors pick up the higher quality names or is the sector dead for a while? Remember when the AI theme kicked off and the ticker $AI was the first mover simply because it was the most obvious name given the ticker. Then NVDA and the “real names” caught stronger bids and provided much longer moves making the 100% AI pop look insignificant. Do we see the same here? If so which less obvious names will come out with a fully fledged and operational business model to supply the Quantum rush (if there is one).

Both FORM & VECO have some interesting potential here and both and revenue producing companies with strong management teams and reasonable balance sheets.

Currently gathering a list of said names and will keep an eye on things as they progress.

Energy (XLE) is currently leading the charge, with a few alternative energy names & Tan putting in a strong recovery following the weak open. FLNC also holding well here but yet to see a strong bid step in.

China capitulated by what appeared to be Algo selling and stops getting hit, again, beautiful price action into extension levels providing a nice entry point which we took advantage of.

**Robotic names are also providing the perfect backdrop:**

First you have millions of people rushed into the garbage names such as $RR only to get bagged by a 75% drop from pre market highs in days. Those same people given the characteristics of the general population will now bag hold their entire positions and/or get liquidated. These moves will create distrust in the higher quality names such as ARBE, INDI etc etc. Providing far better R/R opportunities than you would have received had these moves not happened. The hardest part is of course deciding who the true winners will be from a Robotics theme taking place. I see SYM got a PT upgrade to $37 yesterday yet thanks to the carnage it was completely dismissed. I’m a big fan of the business and whilst it trades at a relatively high premium it’s very likely to become a clear winner over the years. It’s also held extremely well the past week given the market backdrop, collapse in Robotic names, accounting errors and lawsuits. Somebody clearly wants in and is taking advantage of this opportunity, I feel selling the $20 puts and also getting long is a nice play.

In regards to ARBE, I wanted to sell the $2.50 puts for $0.45 cents that expire in 38 days but my Indian Wifi had others ideas. If we pull back today at open that’s exactly what I plan to do. The recent offering presents a nice oppurtunity and de-risks the play in the short term. If you can collect the $0.45 in premium and got filled at $2.50 then you’d have to slam to $2 before taking a net loss. Very very nice R/R thanks to those juiced premiums.

Aside from that I remain focused on the potential themes & letting longer term positions play out.

Leave a Reply