**Weekly Trend:**

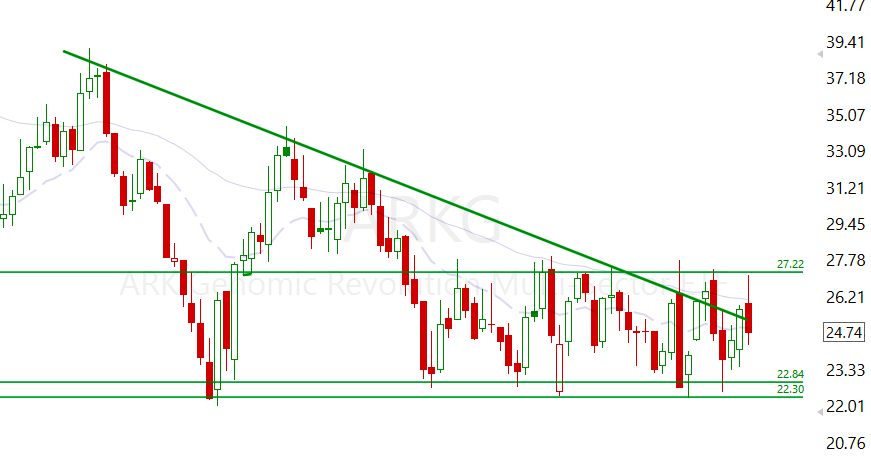

**SPY:** Downtrend **QQQ:** Uptrend **XLE:** Downtrend **ARKG:** Downtrend

**Current Themes on Watch**

AI Biotech (ARKG, RXRX, PRME etc) Once again the entire sector has stuffed and I remain waiting to put on strong size. The thesis is the same as it has always been, just waiting for the market to agree.

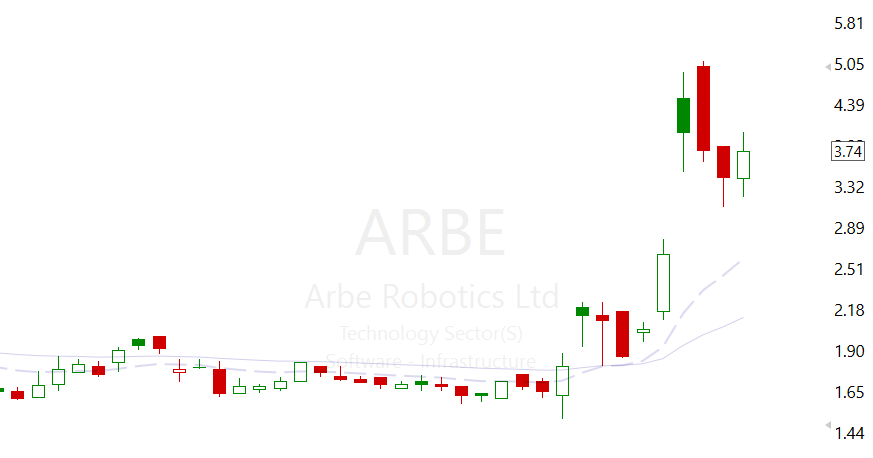

Robotics (OUST, SYM, TESLA, SERV etc) Beautiful, beautiful stuffs across the board. Considering many are back to their chop zones it now means most of the robotic names have just bagged a load of participants. I’ll be watching for a strong flush out to add size back into weekly support. ARBE looks to be the most hungry for pushing higher, even the offering could barely deter it.

Energy (XLE, Natural Gas, Coal, Oil, Plug) The sector still remains strong and is now the leading sector of 2025 so far. Oil is pushing for $80/barrel and Natural Gas attempting to break out of this huge post-covid era base.

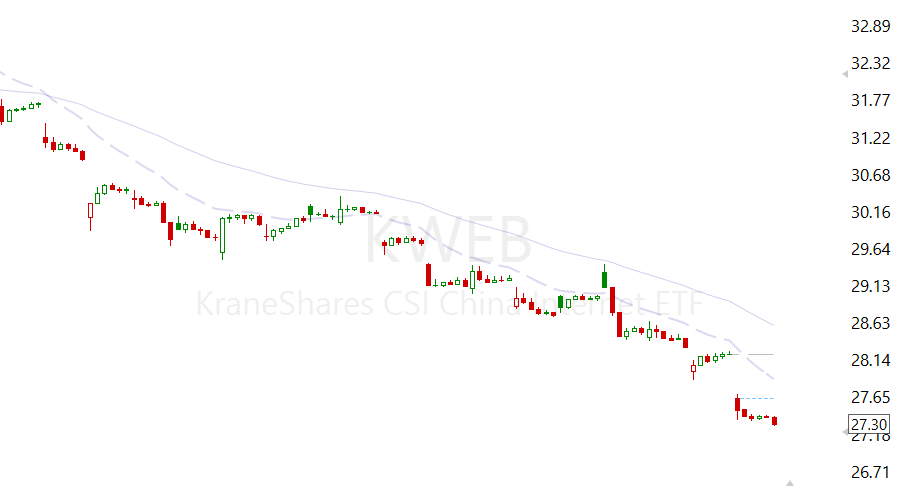

China (KWEB, BABA, JD, BIDU etc) Once again a slaughter house and straight back into extension levels, HK50 is at 18,740 at the time of writing this. China happened to be my largest NET gain last year, and now its setting up for another huge R/R opportunity. Whilst most hate the volatility of this sector I relish it. I hope that sentiment gets more bearish and then we just once again buy the pivot.

**Names on watch for new entry or add (dependant on market)**

Sell Cash-Secured Puts on BIDU, PEP, SYM

KWEB – 65 Min Pivot

**Names added/removed from In Focus List**

None. (updated 13th Jan 2025)

**Names currently flagged:**

WOLF – What happened to this name?

AZUL – Brazilian airline, is it any good?

**Daily Brief:**

It’s nice to see an aggressive pullback, especially in the high flyer names with no revenue. The quantum sector, battery tech, unprofitable biotech, E-vtol, robotics all getting punished with almost every name now in a downtrend.

Large caps also got hit and consumer staples have breached downside extension levels. SPY has put in a lower high and lower low and QQQ is at the same price as July 2024.

As we discussed just a few weeks back, the markets were not as strong as a few high flying names would lead you to believe. Banks and a few other sectors look ok, but not something I want to trade at these levels.

My main focus still remains on Robotics, Energy, China, Latin America & some biotech. All have the potential to become very strong and lasting themes, as in, they could easily remain in play throughout 2025 once they get moving.

**ARKG** – (Update) Still no movement here and still a pure chop, NTLA investors sold into the the mass layoffs and focus on their late stage pipeline. Honestly, I find the reaction a little strange but who am I to argue. BEAM remains strong, RXRX pure chop with moves into $8-9 repeatedly stuffing. A close over than $27.22 region will push us into the trade, until then sitting tight.

**$ARBE** No revenue, Cash burning & recent offering, yet look how strong the chart remains. This is the type of name that can completely destroy a short seller, their “fundamental” analysis may be correct for now but I do not believe investors in this name care. INDI & ARBE are most certainly my favourite plays in the robotic chip sector. In the event we get a weak day I see this as an opportunity to add.

**$KWEB** Waiting patiently for the pivot, will look to scoop more China in my long term account as we breach extension levels.

Aside from that, waiting patiently with little to do here.

Leave a Reply